Why Your Emergency Fund Is the Smartest Move You’ll Ever Make

What if I told you the most powerful financial tool isn’t a stock tip or a side hustle—but a simple savings cushion? I used to think emergency funds were boring, until I faced a surprise expense that nearly wiped me out. That’s when I realized: real financial freedom starts with preparation, not profit. This isn’t about getting rich quick—it’s about staying secure when life throws curveballs. Let’s talk about how building this safety net changed my entire approach to money. It wasn’t glamorous, but it was transformative. And the best part? It’s something anyone can start, no matter their income level or financial history. This is the quiet cornerstone of lasting stability—the kind that doesn’t depend on market swings or lucky breaks.

The Wake-Up Call: Why Emergencies Hit Harder Than We Expect

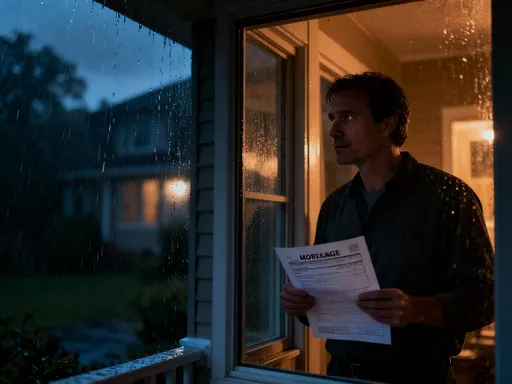

Life rarely follows a script. One moment, everything feels under control—bills are paid, groceries are stocked, and the future looks manageable. The next, a flat tire becomes a transmission repair, a fever turns into an ER visit, or a company restructuring leads to a pink slip. These moments don’t announce themselves, and they rarely come with convenient timing. For many households, especially those operating on tight budgets, an unexpected expense of even $1,000 can trigger a chain reaction of stress and compromise. Without a financial buffer, people are forced into reactive decisions that often carry long-term consequences.

Consider the all-too-common scenario of a sudden medical bill. Even with insurance, deductibles, co-pays, and out-of-network charges can add up quickly. When such costs arise, many turn to credit cards as a stopgap. But high-interest rates mean that a $2,000 emergency can balloon into $3,000 or more over time, especially if payments are stretched out. This kind of debt doesn’t just strain budgets—it erodes confidence. The emotional toll of financial instability is often underestimated. Anxiety about money can affect sleep, relationships, and even physical health. It’s not just about the dollar amount; it’s about the loss of control.

Similarly, job loss—even temporary—can be devastating without savings. Unemployment benefits, where available, often replace only a portion of income and may come with delays or eligibility restrictions. During that gap, basic needs like rent, utilities, and groceries don’t pause. Families may dip into retirement accounts, incurring penalties and taxes, or rely on family support, which can create tension. These are not signs of poor planning; they are evidence of how fragile financial security can be when it’s built only on current income. The reality is that emergencies are not outliers—they are predictable in their unpredictability. And being unprepared turns a temporary setback into a lasting burden.

The key insight is this: financial resilience isn’t measured by how much you earn, but by how well you can withstand disruption. Those who assume they’re safe because they have a steady paycheck often discover, too late, that income stability doesn’t equal financial security. The difference lies in having a plan for the unplanned. An emergency fund isn’t a luxury for the wealthy—it’s a necessity for anyone who values peace of mind and autonomy. It transforms fear into readiness, and uncertainty into confidence. That shift begins not with a windfall, but with awareness: the understanding that preparation is the most responsible form of financial self-care.

The Foundation of Financial Planning: What an Emergency Fund Really Is

An emergency fund is more than just money set aside—it’s a deliberate financial boundary. Unlike general savings, which might be earmarked for a vacation, a new appliance, or a home upgrade, an emergency fund serves one specific purpose: to cover true, unforeseen crises. This distinction is critical. When people blur the lines between emergency savings and other goals, the fund loses its power. It becomes vulnerable to gradual erosion, spent on things that feel urgent but aren’t truly emergencies. The integrity of the fund depends on clarity: it exists solely to protect you when life takes an unavoidable, costly turn.

So, what qualifies as a real emergency? The answer lies in three criteria: unpredictability, necessity, and urgency. A flat tire that leaves you stranded? Yes. A sudden layoff that halts your income? Absolutely. A medical procedure not covered by insurance? That counts. On the other hand, an annual car registration fee, a birthday gift, or a seasonal wardrobe update—while legitimate expenses—do not qualify. These are foreseeable and should be planned for separately. The emergency fund is not a substitute for budgeting; it’s a supplement to it. It’s the financial equivalent of a fire extinguisher: you hope you never need it, but you’re grateful it’s there when flames appear.

Another common misconception is that high income eliminates the need for an emergency fund. This couldn’t be further from the truth. Wealthy individuals may have more resources, but they also often have higher fixed costs—larger homes, private schooling, complex tax obligations. A sudden drop in income, such as from a business downturn or investment loss, can create significant strain even for high earners. Moreover, financial setbacks don’t discriminate by income level. A surgeon, a teacher, and a small business owner all face similar risks when an unexpected event occurs. The difference is in preparedness, not pay grade.

The structure of the fund matters just as much as its existence. It should be liquid, meaning accessible within days without penalties or market risk. It should be separate from daily checking accounts to reduce temptation and mental confusion. And it should be protected—ideally held in an account insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA). These safeguards ensure that the money remains safe and available when it’s needed most. In essence, an emergency fund is not about growth or returns; it’s about reliability. It’s the financial bedrock upon which all other goals can be built.

How Much Is Enough? Balancing Security and Practicality

There is no universal rule for how large an emergency fund should be, but there is a guiding principle: it should cover your essential living expenses for a period that matches your personal risk profile. The commonly cited benchmark of three to six months of expenses is a useful starting point, but it’s not one-size-fits-all. For someone with a stable job, minimal debt, and strong family support, three months may be sufficient. For a single parent with a variable income or chronic health conditions, eight or even twelve months might be more appropriate. The goal is not to mimic others, but to assess your own vulnerabilities and plan accordingly.

To determine your target, begin by calculating your monthly essential expenses. These include housing, utilities, groceries, transportation, insurance, and any minimum debt payments. Discretionary spending—like dining out, subscriptions, or entertainment—should not be included. Once you have that number, multiply it by the number of months you want to cover. For example, if your essentials total $3,000 per month and you aim for six months, your target is $18,000. This figure may seem daunting, but it’s meant to be achieved gradually, not overnight.

Next, evaluate your risk factors. Job stability is a major consideration. Are you in a field with high demand and low turnover, or does your industry experience frequent layoffs? Do you have specialized skills that make re-employment easier, or would a job search take months? Dependents also play a role—supporting children, aging parents, or a non-working spouse increases financial exposure. Health is another critical factor. Chronic conditions or lack of robust insurance may mean higher out-of-pocket costs during a crisis. Geographic location matters too: living in a high-cost area with limited public transit increases reliance on a working vehicle, making car repairs a more urgent threat.

Given these variables, a phased approach often works best. Start with a mini-goal—say, $500 or one month’s expenses—to build momentum. Once that’s reached, treat it as a milestone and keep going. As your income grows or debts decrease, you can adjust your target upward. The key is progress, not perfection. Even a partial fund can prevent a minor setback from becoming a major disaster. What matters most is that the amount feels meaningful to you—that it provides real comfort in the face of uncertainty. This personalized approach ensures that your emergency fund is not just a number, but a source of genuine confidence.

Where to Keep It: Safety, Access, and Growth (Without Risk)

Once you’ve decided how much to save, the next question is where to keep it. The answer lies in three priorities: safety, liquidity, and modest yield. The emergency fund must be protected from loss, available when needed, and earning something—however small—over time. These requirements rule out many popular options. Stocks, bonds, and mutual funds, while excellent for long-term growth, are too volatile for emergency savings. Real estate and private investments lack the immediacy required. Even standard checking accounts, while accessible, typically offer no interest, allowing inflation to quietly erode the fund’s value.

The most effective homes for emergency savings are high-yield savings accounts, money market accounts, and short-term certificates of deposit (CDs). High-yield savings accounts, offered by many online banks, provide interest rates significantly above the national average while maintaining FDIC insurance up to $250,000. They allow electronic transfers and sometimes check-writing privileges, making funds accessible within one to two business days. Money market accounts, often available through credit unions or banks, may offer check-writing and debit card access, along with competitive rates. Short-term CDs, such as those with three- or six-month terms, offer slightly higher returns but come with early withdrawal penalties, so they’re best used only for the portion of the fund you’re confident won’t be needed immediately.

When choosing a provider, look for institutions with strong financial ratings and clear fee structures. Avoid platforms promising unusually high returns, especially if they lack FDIC or NCUA insurance. Cryptocurrency wallets, peer-to-peer lending apps, and unregulated fintech products may offer tempting yields, but they carry risks that contradict the purpose of an emergency fund. This money is not meant to grow aggressively—it’s meant to be there when you need it, intact and accessible. The slight return from a high-yield account is a bonus, not the primary goal.

Another best practice is to keep the emergency fund in a separate institution from your primary bank. This creates a psychological and logistical barrier that reduces impulsive withdrawals. It also protects against system-wide outages or account freezes that could delay access. Automatic transfers from your main account can still make contributions seamless. The ideal setup is one where you can log in, initiate a transfer, and have funds arrive in your checking account within 24 to 48 hours—fast enough for real emergencies, slow enough to discourage casual use. This balance of security and access is what makes the fund both reliable and resilient.

Building It Without Breaking the Budget: Small Steps That Add Up

For many, the biggest obstacle to starting an emergency fund is the belief that they can’t afford it. When every dollar is already spoken for, setting aside even $20 a week can feel impossible. But the truth is, building an emergency fund isn’t about finding extra money—it’s about making it a priority. And that starts with a shift in mindset: treating savings not as a leftover, but as a necessary expense, just like rent or groceries. The most effective savers don’t wait for a raise or a windfall; they start small and stay consistent.

One of the most powerful tools is automation. Setting up a direct transfer from your checking to your savings account—right after payday—ensures that saving happens before spending. This “pay yourself first” approach removes willpower from the equation. Even $25 per paycheck adds up to $1,300 in a year. Over five years, that’s $6,500, not including interest. Apps that round up purchases to the nearest dollar and deposit the difference can also contribute meaningfully over time. These micro-savings strategies work because they’re painless, requiring no major lifestyle changes.

Another approach is to redirect small, non-essential expenses. For instance, skipping a weekly coffee run could save $80 a month. Packing lunch four days a week instead of buying it might free up $150. Canceling unused subscriptions or switching to a lower-cost phone plan can yield hundreds annually. These aren’t sacrifices in the traditional sense—they’re conscious choices to fund security over convenience. The key is to channel those savings directly into the emergency fund, not let them blend back into spending.

Windfalls, however modest, offer another opportunity. Tax refunds, bonuses, cash gifts, or even the proceeds from selling unused items can provide a meaningful jump-start. Instead of spending the entire amount, commit to allocating a portion—say, 50% or more—to the fund. This strategy accelerates progress without disrupting your regular budget. Over time, these small actions compound, turning what once seemed unattainable into a tangible reality. The power lies not in the size of each contribution, but in the consistency of the habit. An emergency fund built slowly is often more sustainable than one funded by a single large deposit.

Avoiding the Trap: Common Mistakes That Undermine Success

Even with the best intentions, many people unintentionally sabotage their emergency funds. One of the most common errors is using the money for non-emergencies. Holiday shopping, home decor upgrades, or concert tickets may feel urgent in the moment, but they don’t qualify as true crises. Each time the fund is dipped into for convenience, it weakens its purpose and delays recovery. The emotional cost is high, too—guilt and regret can lead to avoidance, making it harder to restart contributions.

Another pitfall is misallocating the fund. Some people invest their emergency savings in stocks, cryptocurrency, or high-risk ventures, hoping for higher returns. While growth is a worthy goal, it has no place in emergency savings. Market volatility means the money might not be available when needed, defeating the entire purpose. Similarly, combining the emergency fund with other savings goals—like a vacation or car down payment—blurs priorities and increases the risk of premature withdrawal.

Then there’s the freeze response: avoiding the topic altogether due to shame, overwhelm, or past financial trauma. Some people ignore their lack of savings because it feels too painful to confront. But silence only prolongs the risk. The healthier approach is honesty—acknowledging the gap, setting a realistic goal, and taking one step at a time. Progress, not perfection, is the measure of success.

To stay on track, establish clear rules and review them regularly. Define in writing what constitutes an emergency. Track withdrawals and commit to replenishing the fund as soon as possible. Consider sharing your goal with a trusted family member or financial counselor for accountability. Most importantly, practice self-compassion. If you do use the fund, don’t give up—reset and keep going. Long-term success isn’t about never making a mistake; it’s about learning from it and staying committed to the bigger picture.

From Survival to Strategy: How an Emergency Fund Powers Bigger Financial Goals

When your emergency fund is fully funded, something profound happens: your relationship with money changes. You no longer operate from a place of fear or scarcity. Instead, you gain the freedom to make thoughtful, strategic decisions. You can consider investing in a retirement account without panic about short-term setbacks. You might pursue a career change, start a side business, or go back to school—knowing you have a buffer if income dips. This fund doesn’t just protect you; it empowers you.

Financial institutions notice stability too. Lenders are more likely to offer favorable terms to borrowers who demonstrate responsible habits, including emergency savings. Insurance providers may view you as lower risk, potentially leading to better premiums. Even psychological well-being improves—studies show that people with emergency funds report lower stress levels and greater life satisfaction. These benefits extend beyond the individual, creating a ripple effect on family dynamics and household harmony.

Moreover, the discipline of building an emergency fund often spills over into other areas of financial life. It fosters better budgeting, smarter spending, and a long-term mindset. Once the foundation is solid, other goals—like paying off debt, buying a home, or saving for education—become more achievable. The emergency fund is not the end of the journey; it’s the first, most critical step.

In the end, wealth is not just about accumulation—it’s about resilience. The smartest financial move you can make isn’t chasing the next big return; it’s ensuring you’re never forced into a bad decision. An emergency fund gives you time, space, and dignity when life is at its most unpredictable. It’s not flashy, but it’s fundamental. And for anyone seeking true financial peace, it’s the most powerful tool they already have the power to create.