How I’m Building Freedom by Riding Today’s Market Waves — A Beginner’s Journey

What if you could design a life where work isn’t mandatory, and time is truly yours? That’s the dream driving me to pursue financial freedom and early retirement. I’m not a Wall Street pro — just someone learning how market trends can work in my favor. Along the way, I’ve made mistakes, adjusted strategies, and discovered practical ways to grow wealth while managing risk. This is my real journey, shared to help you avoid common pitfalls and build a smarter path forward. It’s not about getting rich overnight, but about making consistent, thoughtful choices that compound over time. For many women in their 30s to 50s, this path offers more than money — it offers control, peace of mind, and the ability to show up fully in life, on your own terms.

The Freedom Dream: Why Early Retirement Isn’t Just About Quitting Work

Financial freedom is often misunderstood as a desire to stop working. In reality, it’s about gaining the ability to choose how and when you engage with work. For many women balancing family, career, and personal aspirations, the idea of early retirement isn’t rooted in laziness — it’s rooted in the need for autonomy. It means having enough passive income to cover essential living costs, so that work becomes optional rather than obligatory. This shift in mindset transforms the way money is viewed: not as a measure of success, but as a tool for living with intention.

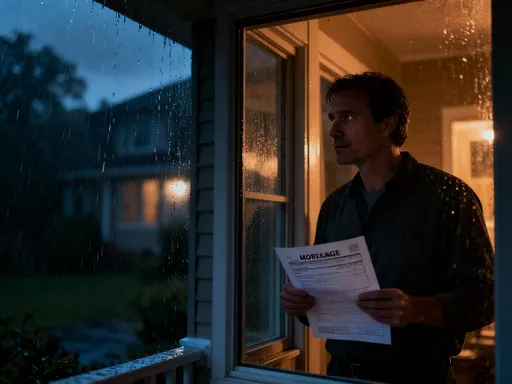

The appeal of financial independence has grown stronger in recent years, especially as economic uncertainty, rising costs, and changing job markets make long-term career stability less guaranteed. More people are realizing that relying solely on a traditional 40-year career path followed by Social Security may not be enough to maintain their desired lifestyle. This awareness has led to a quiet movement — one where individuals are taking proactive steps to build wealth outside of employer-based plans. The goal is not extravagance, but security: knowing that even if life throws unexpected challenges, there’s a financial cushion to fall back on.

For women who often take time away from paid work for caregiving or other family responsibilities, early retirement planning offers a unique advantage. It allows for gaps in employment without derailing long-term financial health. By starting early and focusing on steady growth, it’s possible to accumulate assets that generate income regardless of job status. This kind of resilience is especially valuable during midlife, when priorities often shift from career advancement to quality of life, health, and relationships. Financial freedom, in this sense, becomes a form of emotional freedom — the ability to make decisions based on what truly matters, not just what pays the bills.

Market Trends That Matter: Seeing the Big Picture Without Overcomplicating It

Understanding market trends doesn’t require a finance degree or hours spent watching stock tickers. What it does require is awareness — the ability to recognize broader economic patterns that influence investment performance over time. Inflation, interest rates, technological change, and demographic shifts are not abstract concepts; they directly affect how money grows (or doesn’t grow) in different types of accounts and assets. The key is not to predict every turn, but to position your portfolio so it can adapt to changing conditions without requiring constant intervention.

Inflation, for example, quietly erodes purchasing power. If your savings earn 2% interest while inflation runs at 3%, you’re effectively losing ground. This is why keeping all your money in low-yield savings accounts, while safe, may not be the best long-term strategy. On the other hand, locking into long-term fixed-rate investments during periods of rising interest rates can also limit growth potential. Being aware of these dynamics allows you to make informed decisions — such as favoring short-to-medium term bonds when rates are expected to rise, or increasing exposure to dividend-paying stocks during high inflation periods.

Technological advancements are another powerful force shaping today’s markets. Automation, artificial intelligence, and digital transformation are not just buzzwords — they’re reshaping entire industries. Companies that adapt thrive; those that don’t risk becoming obsolete. As an investor, this means paying attention to sectors undergoing innovation, not because they promise quick gains, but because they represent long-term structural changes. However, it also means avoiding the temptation to chase every new trend. Investing in broad-based index funds that include innovative companies offers exposure without the risk of betting on individual winners.

Demographics also play a crucial role. As populations age in many developed countries, demand for healthcare, retirement services, and income-generating assets increases. This creates opportunities in specific sectors, but more importantly, it reinforces the need for personal financial preparedness. If more people are living longer, retirement savings must last longer too. Recognizing these macro trends helps frame investment decisions within a realistic context, reducing the emotional reaction to short-term market swings and focusing instead on sustainable growth aligned with long-term goals.

Starting Small: How Beginners Can Gain Ground Without Big Risks

One of the most common barriers to starting an investment journey is the belief that you need a large sum of money to begin. The truth is quite the opposite: starting small with consistent contributions can be more effective than waiting to invest a large lump sum later. The power of compounding works best over time, meaning that even modest amounts invested early can grow significantly over decades. For someone in their 30s or 40s, this time advantage is one of the most valuable tools available.

Consider two scenarios: Person A starts investing $200 per month at age 35 and continues until 65, earning an average annual return of 7%. By retirement, they’ve contributed $72,000 and their portfolio grows to approximately $220,000. Person B waits until age 45 to start, investing the same amount monthly. By 65, they’ve contributed $48,000 but end up with only about $100,000. The difference isn’t due to higher contributions — it’s due to time. This example illustrates why starting early, even with small amounts, is so powerful.

For beginners, low-cost index funds are one of the most effective entry points. These funds track broad market benchmarks like the S&P 500 and offer instant diversification across hundreds of companies. Because they’re passively managed, their fees are significantly lower than actively managed funds, which means more of your returns stay in your pocket. Many brokerage platforms now allow automatic investments as low as $25 per month, making it easy to build the habit of consistent saving without financial strain.

Another advantage of starting small is the opportunity to learn without high stakes. As you watch your portfolio grow — and sometimes shrink — you gain real-world experience in managing emotions around market volatility. You learn not to panic when prices drop, and not to get overly excited when they rise. This emotional resilience is just as important as financial knowledge. Over time, small, disciplined actions build not only wealth but confidence — the quiet certainty that you’re moving in the right direction, even when progress feels slow.

Earning While Protecting: Balancing Growth and Risk in Volatile Times

Growth and protection are not opposites — they are two sides of the same financial strategy. A portfolio designed only for high returns often carries high risk, which can lead to significant losses during market downturns. Conversely, a portfolio focused solely on safety may fail to keep up with inflation, eroding purchasing power over time. The goal is balance: building a mix of assets that can grow steadily while also providing stability during uncertain periods.

Asset allocation is the foundation of this balance. It refers to how your investments are divided among different categories — typically stocks, bonds, and cash. Stocks offer higher growth potential but come with more volatility. Bonds are generally less volatile and can provide steady income, though with lower long-term returns. Cash and cash equivalents offer safety and liquidity but little growth. The right mix depends on your age, risk tolerance, and timeline. For example, someone in their 30s might allocate 70% to stocks and 30% to bonds, while someone nearing retirement might reverse that ratio to prioritize capital preservation.

Dollar-cost averaging is another powerful tool for managing risk. Instead of investing a large sum all at once, you spread your investments over time — say, $300 per month into a stock index fund. This approach reduces the risk of buying at a market peak, because you’re purchasing shares at different prices over time. When prices are high, you buy fewer shares; when prices are low, you buy more. Over the long term, this smooths out the average cost per share and reduces emotional decision-making.

Equally important is the role of an emergency fund. Before investing heavily in the market, it’s wise to set aside three to six months’ worth of living expenses in a liquid, low-risk account. This buffer protects you from having to sell investments during a downturn to cover unexpected costs like car repairs or medical bills. Knowing you have this safety net allows you to stay invested for the long term, even when markets fluctuate. Emotional discipline, supported by practical safeguards, is what turns a well-designed strategy into lasting results.

Smart Moves That Save More Than They Earn: The Hidden Power of Cost Control

Many people focus on increasing returns, but few pay attention to reducing costs — and the difference can be staggering. Over a 30-year investment period, a 1% difference in annual fees can reduce your final portfolio value by 25% or more. This isn’t hypothetical; it’s math. High expense ratios, trading commissions, and tax inefficiencies quietly drain wealth, often without investors even noticing. The good news is that controlling these costs is entirely within your control — and the impact compounds just like investment returns.

Expense ratios are one of the most significant yet overlooked factors. An actively managed mutual fund might charge 1.0% or more in annual fees, while a comparable index fund might charge 0.03%. That 0.97% difference doesn’t sound like much each year, but over decades, it adds up to tens of thousands of dollars. Imagine earning an extra 1% return every year — that would be considered exceptional. Yet, simply choosing lower-cost funds can deliver a similar boost without taking on additional risk.

Taxes also play a major role in net returns. Investment accounts like 401(k)s and IRAs offer tax advantages that can significantly enhance growth. For example, contributions to a traditional IRA may be tax-deductible, and earnings grow tax-deferred until withdrawal. Roth accounts, on the other hand, allow for tax-free withdrawals in retirement. Using these accounts strategically — and avoiding unnecessary taxable brokerage account trades — can preserve more of your gains. Additionally, holding investments for more than a year qualifies you for lower long-term capital gains tax rates, another small but meaningful advantage.

Behavioral costs are harder to measure but just as real. Lifestyle inflation — the tendency to spend more as income increases — can sabotage even the best investment plan. Similarly, frequently switching between funds or trying to time the market often leads to underperformance. Studies consistently show that individual investors earn lower returns than the funds they own, simply because they buy high and sell low due to emotional reactions. Avoiding these pitfalls doesn’t require perfection — just awareness and a commitment to consistency. Every dollar saved in fees, taxes, or unnecessary spending is a dollar that can grow for your future.

Tools and Habits That Keep You on Track — Without Obsessing Daily

Sustainability is the secret to long-term financial success. The most effective investors aren’t the ones checking their portfolios daily or reacting to every news headline — they’re the ones who set up systems that work automatically and review progress periodically. Automation is one of the most powerful tools available. Setting up automatic transfers to investment accounts ensures consistency without requiring constant willpower. Over time, this small habit creates momentum that’s difficult to achieve through sporadic effort.

Regular but infrequent reviews — such as quarterly or annually — are enough to stay on track. During these check-ins, you can assess whether your asset allocation still aligns with your goals, rebalance if necessary, and adjust contributions based on changes in income or expenses. This structured approach reduces decision fatigue and prevents emotional reactions to short-term market movements. It also frees up mental energy for more meaningful aspects of life, like family, health, and personal growth.

Mindset plays a crucial role in maintaining discipline. Comparison is a common trap — seeing others’ apparent success on social media or hearing about market winners can create pressure to take bigger risks. But everyone’s financial journey is different. What matters is your progress toward your own goals, not someone else’s highlight reel. Impatience is another challenge. Wealth building is slow at first, then accelerates over time. Trusting the process, even when results aren’t immediately visible, is essential.

Tracking progress in a simple way — such as maintaining a spreadsheet or using a financial dashboard — can provide motivation without obsession. Seeing your net worth grow steadily, even if slowly, reinforces positive behavior. Celebrating milestones, like reaching $10,000 in investments or paying off a credit card, builds confidence. These habits aren’t about achieving perfection — they’re about creating a rhythm that supports long-term success without burnout. Financial freedom isn’t built in a day, but through daily choices that add up over years.

Building Your Own Path: Adapting Strategies as Life Changes

There is no single blueprint for financial independence. What works for one person may not work for another, and that’s okay. The most important thing is to build a plan that reflects your values, responsibilities, and vision for the future. For some, early retirement means traveling the world; for others, it means spending more time with family, volunteering, or pursuing creative passions. The definition of freedom is personal — and so should be the path to achieving it.

Life is unpredictable. Job changes, health issues, family needs, or economic shifts can all impact your financial timeline. A rigid plan may break under pressure; a flexible one can adapt. This doesn’t mean abandoning goals — it means adjusting strategies when necessary. For example, if you take time off to care for a parent, you might temporarily reduce investment contributions. That’s not failure; it’s responsible prioritization. Later, when circumstances allow, you can increase contributions or extend your retirement timeline slightly to compensate.

Regular reflection is key. Every few years, take time to reassess your goals, risk tolerance, and financial situation. Are you on track? Do your investments still align with your values? Has your view of retirement changed? These questions help ensure your plan remains relevant and meaningful. They also empower you to make intentional choices rather than simply reacting to external pressures.

Financial independence is not a destination — it’s a journey of continuous learning and adjustment. It’s about building resilience, not just wealth. It’s about creating a life where you have choices, even when circumstances change. For women navigating complex roles and responsibilities, this kind of flexibility is invaluable. By staying informed, staying consistent, and staying true to your own priorities, you can ride the waves of today’s markets with confidence — not because you control the market, but because you control your response to it. That, ultimately, is the truest form of freedom.