How I Manage Money Without Losing Sleep — A Real Fund Strategy Guide

What if managing your funds didn’t feel like gambling? I used to overthink every move, chasing returns and dodging losses—until I found a smarter way. This isn’t about get-rich-quick tricks. It’s about building a clear, balanced approach to asset allocation that actually works. I’ve tested it, tweaked it, and stuck with it. Here’s how I stay on track without stress—and how you can too. The journey wasn’t instant. It began with frustration—watching markets swing wildly, making emotional trades, and wondering why my portfolio never seemed to grow steadily. Like many, I believed high returns meant smart investing. But over time, I realized that true financial progress isn’t measured by peaks, but by consistency, protection of capital, and peace of mind. This guide shares the practical, tested framework that transformed my financial life—not through speculation, but through structure, discipline, and intelligent decision-making.

The Problem with Chasing Returns

Many investors fall into the trap of focusing only on gains, ignoring the cost of risk. This mindset often leads to emotional decisions, poor timing, and portfolio damage. I once sold low out of panic—just like millions do. The truth is, chasing performance rarely pays off. Market highs attract crowds, but they also increase vulnerability. Without a structured plan, you're reacting, not managing. Understanding this flaw was my first step toward better fund management. It’s not about avoiding risk entirely—it’s about knowing when and how to take it.

When returns dominate the conversation, risk fades into the background. We hear stories of tech stocks doubling in months or real estate markets surging overnight, and it’s easy to feel left behind. But those stories rarely mention the investors who bought at the peak and held as values dropped by half. The allure of quick profits can distort judgment, leading people to stretch beyond their risk tolerance. I learned this the hard way when I poured a large portion of my savings into a trending sector, only to watch it collapse within a year. The loss wasn’t just financial—it shook my confidence. I realized I had been measuring success by the wrong metric: short-term gains instead of long-term stability.

The danger of return-chasing lies in its emotional foundation. It thrives on excitement, urgency, and the fear of missing out. These feelings override rational analysis. Markets naturally cycle—what’s hot today may cool tomorrow. When investors chase yesterday’s winners, they often buy high and sell low, the exact opposite of sound strategy. Studies have shown that the average investor underperforms the market over time, not because of poor fund choices, but because of poor timing driven by emotion. The solution isn’t to avoid growth opportunities, but to approach them with a plan that defines your risk limits in advance.

Managing money effectively means shifting focus from outcomes to process. Instead of asking, “Which fund had the highest return last year?” the better question is, “Does this investment fit my long-term goals and risk profile?” This mental shift separates disciplined investors from gamblers. It allows you to stay calm during downturns because you know your portfolio was built to withstand them. By acknowledging that high returns come with higher volatility, you can make informed choices rather than impulsive ones. The goal isn’t to capture every upswing, but to avoid catastrophic losses that take years to recover from.

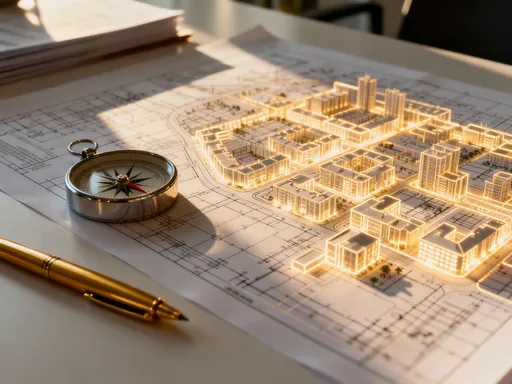

Building Your Foundation: What Asset Allocation Really Means

Asset allocation isn’t just splitting money across stocks and bonds—it’s designing a financial structure that supports your goals. Think of it as the blueprint of a house: without it, everything can collapse. It balances growth potential with stability, aligning investments with your timeline and risk tolerance. I learned this after years of haphazard moves. By categorizing assets into core groups—growth, income, safety—I finally gained clarity. This section breaks down the logic behind each category and how they interact to protect and grow wealth over time.

At its core, asset allocation is about diversification with intention. It’s not enough to own multiple funds; they should serve different roles in your portfolio. The growth portion—typically made up of equities—aims to build wealth over the long term. These assets carry higher risk but offer the best chance for appreciation. The income segment, such as dividend-paying stocks or bonds, provides regular cash flow and tends to be less volatile. Then there’s the safety component, including cash equivalents or short-term instruments, which acts as a buffer during market stress. Together, these layers create a balanced system where no single event can derail your entire financial plan.

Your personal circumstances determine the right mix. A woman in her 40s with children to educate and a mortgage to manage will likely need a more conservative allocation than someone decades from retirement. Time horizon is critical—investments meant to fund a goal in five years should carry less risk than those meant for 25 years. Similarly, your emotional comfort with market swings matters. If you lose sleep when your portfolio dips, your allocation should reflect that. The goal isn’t to maximize returns at all costs, but to create a strategy you can stick with through all market conditions.

One of the most powerful benefits of asset allocation is its ability to smooth out returns. While one asset class may struggle, another may perform well, offsetting losses. For example, when stocks decline during economic uncertainty, high-quality bonds often rise in value as investors seek safety. This inverse relationship can protect your portfolio’s overall value. Over time, this balance leads to more predictable growth, reducing the need for drastic changes. By establishing your allocation in advance, you create a roadmap that guides decisions, not just during calm periods, but especially during turbulent ones.

The Core-Satellite Approach: Structure Meets Flexibility

I found success using the core-satellite strategy—keeping most funds in stable, diversified holdings while allocating a smaller portion to targeted opportunities. The core acts as an anchor, reducing volatility. The satellites allow room for active choices without endangering the whole portfolio. This method gave me peace of mind and enough freedom to explore. It’s not about betting big—it’s about balancing discipline with smart experimentation. I’ll explain how to size each part and what types of funds fit best in both roles.

The core typically makes up 70% to 80% of the portfolio and consists of broad-market index funds or ETFs that track major benchmarks like the S&P 500 or total bond market. These holdings provide exposure to the overall economy and have historically delivered solid long-term returns with relatively low fees. Because they’re diversified and passively managed, they require minimal maintenance. This foundation ensures that even if my satellite picks underperform, the majority of my money remains on a steady growth path. The core is not meant to outperform the market—it’s meant to keep pace with it, reliably and consistently.

The satellite portion, usually 20% to 30%, allows for more personalized choices. This is where I might invest in sector-specific funds, international markets, or dividend growth stocks that align with my outlook. These selections are based on research, not hunches, and are always evaluated against my overall risk limits. The key is to keep satellites small enough that a loss won’t significantly impact the portfolio. For example, if I believe renewable energy will grow over the next decade, I might allocate a portion of my satellite budget to a clean energy ETF. But I don’t go all in—I limit exposure so that even if the sector underperforms, my core remains intact.

This structure offers psychological benefits as well. Knowing that most of my money is in stable, low-cost funds reduces anxiety when satellite investments fluctuate. It also prevents overconfidence—if a satellite pick does well, I don’t feel compelled to chase it further because it’s already capped. The core-satellite model creates a natural check on emotions. It supports learning and engagement without sacrificing security. Over time, I’ve found that this balance keeps me involved in my finances without becoming obsessed with daily market movements. It’s a sustainable way to manage money—one that honors both caution and curiosity.

Risk Control: Protecting Gains Like a Pro

Preserving capital is just as important as growing it. I used to ignore warning signs until losses hit hard. Now, I use systematic checks—like rebalancing and stop-loss logic—to maintain balance. Diversification isn’t a one-time fix; it needs regular upkeep. I also monitor correlations between assets, avoiding hidden overlaps that increase risk. This part covers practical techniques to reduce exposure without sacrificing growth potential. It’s not about fear—it’s about staying prepared.

Risk control begins with awareness. Many investors assume they’re diversified because they own multiple funds, but if those funds hold similar stocks or react to the same economic factors, the portfolio remains vulnerable. For example, owning several technology-focused ETFs may feel like variety, but in a sector-wide downturn, they could all decline together. True diversification means spreading investments across different asset classes, industries, and geographies so that they don’t move in lockstep. I review my holdings periodically to ensure I’m not overexposed to any single area, even unintentionally.

One of my most effective tools is rebalancing—not just for returns, but for risk management. Over time, some assets grow faster than others, shifting the original allocation. If stocks outperform bonds, they may come to represent a larger share of the portfolio than intended, increasing overall risk. Rebalancing brings the portfolio back in line by selling some of the appreciated assets and buying more of the underrepresented ones. This does more than restore balance—it enforces the discipline of selling high and buying low, a principle that’s simple in theory but hard to execute emotionally.

I also pay attention to how different assets behave together. Correlation measures how closely two investments move in relation to each other. High correlation means they tend to rise and fall together, which reduces the effectiveness of diversification. By choosing assets with low or negative correlations—such as stocks and bonds, or U.S. and international markets—I improve the portfolio’s resilience. During periods of market stress, having uncorrelated assets can mean the difference between a manageable dip and a severe loss. This level of control doesn’t eliminate risk, but it makes it predictable and manageable.

Smart Rebalancing: When and Why to Adjust

Markets shift, and so should your portfolio—but not too often. I used to over-rebalance, creating unnecessary taxes and fees. Now, I follow a time-and-threshold rule: adjust only when allocations drift beyond a set range or at scheduled intervals. This keeps emotions out of the process. Rebalancing locks in gains from top performers and buys more from underperformers—essentially selling high and buying low. I’ll show how to set personal thresholds and timing that fit your lifestyle and goals.

The key to effective rebalancing is consistency without excess. If done too frequently, it can trigger capital gains taxes in taxable accounts and increase trading costs. If done too rarely, the portfolio may drift far from its intended risk level. My approach combines both time-based and threshold-based triggers. I review my portfolio every six months, but I only rebalance if any asset class has moved more than 5% above or below its target. For example, if my stock allocation is set at 60%, I rebalance when it reaches 65% or drops to 55%. This rule-based method removes guesswork and prevents emotional interference.

Rebalancing also supports long-term discipline. It forces you to take profits from areas that have done well, which can feel counterintuitive when those assets are still rising. But history shows that no asset grows indefinitely—what goes up often comes down. By locking in gains, you protect part of your return. At the same time, buying more of underperforming assets allows you to acquire value at lower prices. This is not market timing—it’s systematic risk management. Over decades, this practice can significantly enhance returns compared to a buy-and-hold strategy that never adjusts.

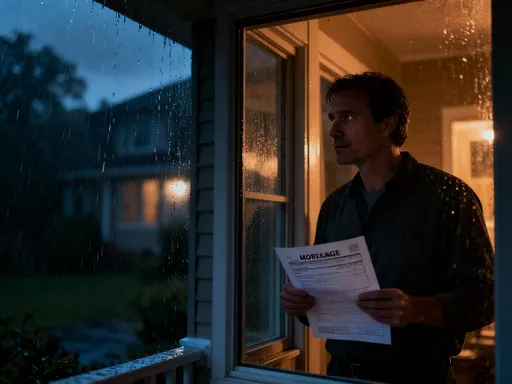

Another benefit of scheduled reviews is that they create natural opportunities to reassess goals. Life changes—children graduate, mortgages are paid off, retirement nears. These milestones may call for a shift in risk tolerance or time horizon. Rebalancing isn’t just about numbers; it’s a chance to realign your portfolio with your current reality. I use these moments to ask whether my allocation still reflects my needs. Am I saving for a new goal? Has my income changed? These reflections ensure that my financial plan remains relevant and responsive, not static.

Low-Cost Tools That Make a Difference

Fees quietly eat into returns, so I switched to low-cost index funds and ETFs for my core holdings. The savings compound over time, boosting net gains. I also use automated platforms to track performance and flag imbalances. These tools don’t pick winners—they keep me consistent. You don’t need fancy software, just reliable, transparent options. This section reviews the types of funds and platforms that support long-term success without hidden costs.

Expense ratios matter more than most investors realize. A fund with a 1% annual fee may seem small, but over 20 years, it can consume a significant portion of your returns. Index funds and ETFs, which track market benchmarks rather than trying to beat them, typically have much lower fees—often below 0.10%. Because they’re passively managed, they require less research and trading, which keeps costs down. By using these for my core portfolio, I’ve reduced expenses dramatically. The difference may seem minor year to year, but over decades, it adds up to tens of thousands of dollars in extra growth.

Transaction costs are another hidden drain. Frequent trading, especially in taxable accounts, can generate fees and taxes that erode profits. I minimize this by choosing funds with no transaction fees and holding them for the long term. Many brokerage platforms now offer commission-free trading on thousands of ETFs, making it easier than ever to build a low-cost portfolio. I also avoid funds with sales loads or 12b-1 fees, which provide no benefit to the investor. Transparency is key—I only invest in funds that clearly disclose all costs upfront.

Beyond fund selection, I rely on digital tools to maintain consistency. Portfolio trackers allow me to see my asset allocation at a glance and receive alerts when rebalancing is needed. Some platforms even offer automated rebalancing, which executes trades based on my preset rules. These features aren’t about replacing judgment—they’re about supporting it. They reduce the mental load of managing money, making it easier to stay on track. For busy women juggling family, work, and personal goals, these tools offer peace of mind without requiring constant attention.

Staying Consistent: The Real Key to Long-Term Success

The biggest challenge isn’t strategy—it’s behavior. I’ve stuck with my plan through market swings by focusing on process, not outcomes. Discipline beats brilliance in fund management. Setting clear rules, reviewing regularly, and avoiding impulsive moves made all the difference. This final part emphasizes mindset, routine, and patience. Success isn’t dramatic—it’s quiet, consistent action over time. That’s how real wealth builds.

Markets will always test your resolve. There will be years of strong gains that tempt you to take on more risk, and years of losses that make you want to sell everything. But the most successful investors aren’t those who predict the market—they’re the ones who stick to their plan. I’ve learned to celebrate small victories: following my rebalancing schedule, resisting the urge to react to headlines, and reviewing my goals annually. These actions don’t make headlines, but they compound into lasting financial security.

Creating a routine has been essential. I set specific times each year to review my portfolio, update my budget, and assess my progress. This isn’t a burden—it’s a form of self-care. Just as regular check-ups protect your health, financial reviews protect your future. I involve my family in these conversations, not to burden them, but to ensure everyone understands our goals. This shared awareness builds confidence and reduces stress during uncertain times.

Patience is the quiet engine of wealth. Compounding returns work slowly, but they build power over time. A disciplined approach may not feel exciting, but it’s reliable. I no longer measure success by quarterly statements, but by whether I’m still on track toward my long-term objectives. That sense of stability has given me more than financial growth—it’s given me freedom from anxiety. Managing money doesn’t have to be stressful. With the right structure, tools, and mindset, it can be a source of confidence and control. That’s the real reward of smart fund management—not just more money, but a better life.