How I Build Wealth Through Smarter Real Estate Layouts

What if your real estate investments could work harder without you chasing every market trend? I’ve tested different strategies, made mistakes, and finally cracked a layout method that balances growth and safety. It’s not about flipping houses or gambling on hot markets—it’s about smart positioning. In this article, I’ll walk you through how structuring your portfolio with intention can unlock steady progress while keeping risks in check. This approach isn’t reserved for Wall Street insiders or real estate moguls. It’s accessible to anyone willing to think beyond the price tag and consider how their properties fit together as part of a larger financial design. The difference between random ownership and strategic layout is like the difference between stacking bricks and building a home—both use materials, but only one creates lasting value.

The Problem with Random Real Estate Investing

Many people enter real estate with excitement but little strategy, drawn in by stories of quick profits or the appeal of owning property. They buy homes based on gut feeling, attractive photos, or what’s trending in the local market. While enthusiasm is valuable, it rarely leads to consistent financial results. Without a clear investment layout, these purchases often result in a patchwork portfolio—properties that don’t complement each other, lack coordination in timing or location, and fail to serve a unified financial goal. This randomness creates inefficiencies that erode returns over time.

Consider the investor who buys a high-end condo in a downtown area, then a rental house in a distant suburb, followed by a vacation cabin in a seasonal market. On paper, each might seem like a solid deal. But together, they represent vastly different maintenance needs, tenant profiles, and market risks. Managing them becomes a logistical burden, and their financial performance rarely aligns. One may appreciate slowly while the other struggles with vacancy. One requires constant repairs while another sits idle for months. The lack of a cohesive structure means the investor reacts to problems rather than guiding outcomes.

Beyond operational challenges, random investing increases exposure to market volatility. If all properties are concentrated in one region and that market cools, the entire portfolio suffers at once. There’s no buffer, no balance. Emotional decisions often drive these choices—buying because a friend did, or fearing missing out on a so-called “hot” neighborhood. These impulses bypass critical analysis and long-term planning. The result? Underperforming assets, unexpected expenses, and frustration when returns don’t match expectations. Real estate, unlike stocks or bonds, doesn’t trade easily. Once you own a property, you’re committed for the long haul. That makes the initial layout decision even more crucial.

Another hidden cost of disorganized investing is opportunity cost. Money tied up in a poorly performing asset could have been used to acquire something with stronger cash flow or better appreciation potential. Without a layout framework, investors miss chances to rebalance, upgrade, or shift focus based on changing life circumstances. They stay stuck because they don’t see their portfolio as a system but as a collection of separate transactions. The truth is, owning property isn’t the same as building wealth. Wealth comes from how those properties are selected, positioned, and managed over time. A strategic layout transforms real estate from a passive expense into an active engine of financial growth.

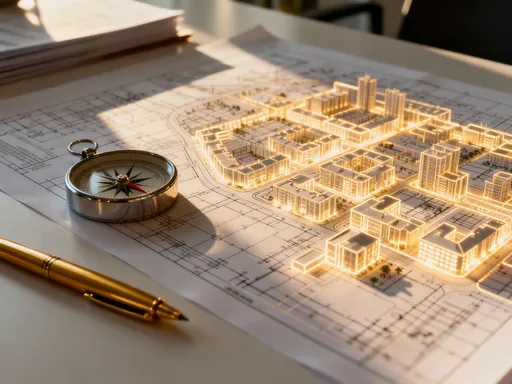

What Is Investment Layout, and Why It Changes Everything

Investment layout is the deliberate organization of your real estate holdings to achieve specific financial objectives. It’s not just about what you buy, but how each property fits within the broader picture of your portfolio. Think of it as urban planning for your wealth—zoning certain areas for income, others for growth, and some for stability. This structured approach replaces guesswork with intention, ensuring that every acquisition supports a larger purpose. When done right, investment layout turns a group of individual properties into a coordinated financial ecosystem.

At its core, investment layout involves three key dimensions: property type, geographic location, and income model. Each decision in these areas affects risk, return, and management effort. For example, choosing between a single-family rental and a small multifamily unit changes your tenant base, cash flow profile, and maintenance demands. Buying in a growing suburban area versus a dense urban center alters appreciation potential and market sensitivity. Deciding whether to pursue long-term rentals, short-term leases, or value-add renovations shapes your involvement and income rhythm. A smart layout considers all these factors in advance, creating a roadmap for consistent progress.

Why does this matter more than chasing individual deals? Because isolated wins don’t guarantee long-term success. You might find a great bargain on a house today, but if it doesn’t align with your overall strategy, it could pull resources away from more strategic opportunities. Investment layout shifts the focus from short-term transactions to long-term design. It forces you to ask not just “Is this property a good deal?” but “Does this property belong in my portfolio?” That subtle shift in thinking leads to better decision-making, fewer regrets, and more predictable outcomes.

Moreover, a well-structured layout enhances resilience. Markets change. Recessions happen. Tenant demands evolve. A portfolio built with balance in mind can absorb shocks without collapsing. For instance, if short-term rentals decline due to regulatory changes, having a portion of long-term leases provides stability. If urban prices stagnate, suburban holdings might continue growing. This diversification within real estate—often overlooked—is just as important as diversifying across asset classes. The layout becomes a risk management tool, not just a growth strategy. It allows investors to sleep better at night, knowing their wealth isn’t riding on a single market or property type.

Ultimately, investment layout changes the relationship between the investor and their assets. Instead of reacting to market noise, you operate from a position of clarity. You know why each property is there, what role it plays, and when it might need adjustment. This level of control fosters confidence and reduces stress. It also makes scaling easier—adding new properties becomes a matter of filling gaps in the layout, not starting from scratch each time. In a world where financial success often feels out of reach, investment layout offers a practical, structured path forward.

Mapping Out Your Real Estate Zones

To build a resilient real estate portfolio, think of it as a city with distinct districts—each serving a unique economic function. Just as a well-planned city has residential neighborhoods, commercial hubs, and industrial zones, your portfolio should include areas dedicated to different financial goals. These zones act as categories that guide your buying decisions and help maintain balance. By assigning properties to specific zones, you create a system that works together, rather than a random assortment of real estate holdings.

The first zone is the Cash Flow District. This includes properties selected primarily for their ability to generate reliable monthly income. These are typically located in areas with strong tenant demand, such as near schools, hospitals, or employment centers. Single-family homes in family-oriented suburbs, duplexes in established neighborhoods, or small apartment buildings in growing towns often fit here. The goal is consistency—not speculative gains. These properties cover their own expenses, provide surplus income, and serve as the financial foundation of the portfolio. They’re the steady paycheck in a world of market uncertainty.

The second zone is the Growth Corridor. This area focuses on long-term appreciation rather than immediate income. Properties here are often in emerging markets, redevelopment zones, or cities with strong population growth. They may have lower initial yields or require more management, but the expectation is that their value will rise significantly over time. Examples include condos in revitalizing downtown areas or land in expanding suburbs. The Growth Corridor is where wealth compounds silently, building equity that can be leveraged later. It requires patience, but the rewards can be substantial when timed well.

The third zone is the Stability Reserve. These are low-volatility assets that protect the portfolio during downturns. They might include government-backed housing, properties in recession-resistant markets, or well-maintained rentals in stable neighborhoods. The Stability Reserve doesn’t aim for high returns; it aims for safety. When other markets fluctuate, these properties continue to perform, providing confidence and liquidity when needed. They act as ballast, preventing the entire portfolio from tilting during economic shifts.

Some investors also create a Flex Zone for experimental or transitional assets. This could include fixer-uppers, short-term rentals, or properties in niche markets. The Flex Zone allows for innovation without jeopardizing the core portfolio. It’s where you test new strategies, learn about different markets, or take calculated risks. But it’s kept small—usually no more than 10–15% of total holdings—to limit exposure. By clearly defining these zones, you gain clarity on where to allocate capital, when to hold, and when to sell. The layout becomes a living document, guiding decisions with logic rather than emotion.

Balancing Risk and Reward Across Markets

Putting all your real estate eggs in one basket—whether it’s a single city, property type, or investment style—is one of the most common and costly mistakes. While it may feel safer to invest locally or stick with what you know, overconcentration increases vulnerability to localized downturns. A job loss in one industry, a change in zoning laws, or a drop in tourism can devastate an undiversified portfolio. Smart investors mitigate this by spreading their holdings across different markets, creating a balance that maintains growth potential while reducing risk.

Geographic diversification is a cornerstone of a strong layout. Owning properties in multiple regions means that if one market slows, others may continue performing. For example, a rental in a college town benefits from steady tenant turnover, while a home in a retirement community offers long-term leases and lower maintenance. A property in a high-cost urban area may appreciate faster, while one in a mid-sized city provides stronger cash flow. By combining these, you capture different economic drivers and reduce dependence on any single trend. Technology makes remote management more feasible than ever, allowing investors to build portfolios beyond their immediate vicinity without sacrificing control.

Equally important is diversification across property types. Residential, commercial, and mixed-use properties respond differently to market conditions. Single-family homes appeal to families and long-term renters, while small multifamily units attract investors seeking scale. Townhouses in suburban developments serve a different demographic than lofts in converted warehouses. Each has unique demand patterns, expense structures, and regulatory environments. A balanced portfolio includes a mix that aligns with your goals and risk tolerance. For instance, multifamily units often provide better economies of scale—more units mean more income streams and less reliance on a single tenant.

Market maturity is another layer of diversification. Emerging markets—cities with growing populations, new infrastructure, or business expansions—offer higher appreciation potential but come with more uncertainty. Stable markets—established cities with consistent rental demand—provide reliability but may grow more slowly. A strategic layout includes both: enough exposure to emerging areas to capture growth, and enough presence in stable markets to ensure income continuity. This dual approach allows investors to benefit from upswings without being wiped out by downturns.

Additionally, consider economic drivers. Some markets thrive on education, others on healthcare, manufacturing, or government employment. When one sector slows, another may remain strong. By analyzing the underlying economy of each location, you can position properties where demand is less likely to vanish overnight. This kind of informed diversification isn’t about scattering investments randomly—it’s about placing them deliberately where they complement each other. The result is a portfolio that doesn’t just survive market cycles but adapts and grows through them.

The Cash Flow Engine: Designing for Consistent Returns

While appreciation grabs headlines, it’s consistent cash flow that sustains long-term wealth. A property that gains value over time is valuable, but one that pays you monthly is transformative. The Cash Flow Engine is the part of your portfolio designed to generate reliable income—money that covers expenses, funds new investments, and supports your lifestyle. Building this engine requires careful selection, smart financing, and ongoing optimization.

The foundation of strong cash flow is tenant demand. Properties in areas with job growth, good schools, and access to transportation naturally attract stable tenants. These locations tend to have lower vacancy rates and fewer evictions, reducing downtime and lost income. Researching local demographics, employment trends, and rental supply helps identify markets where demand outpaces supply. It’s not enough to like a neighborhood—data should confirm that people want to live there and can afford to pay rent.

Operating costs must also be factored into the equation. A property with high rent but even higher maintenance, property taxes, or management fees may not deliver the expected return. Smart investors analyze net operating income (NOI)—rent minus expenses—to determine true profitability. They also build in buffers for repairs, vacancies, and unexpected costs. This disciplined approach prevents over-leveraging and ensures that cash flow remains positive even when challenges arise.

Financing strategy plays a crucial role. Fixed-rate mortgages provide predictable payments, making it easier to project long-term returns. Avoiding excessive leverage reduces risk and increases resilience. Some investors use cash-out refinancing on appreciated properties to fund new purchases, creating a self-reinforcing cycle of growth. Others reinvest monthly surpluses into savings or low-cost index funds, diversifying their wealth beyond real estate. The key is to design the Cash Flow Engine so it doesn’t just sustain itself but fuels further expansion.

Finally, continuous improvement keeps the engine running efficiently. Regular rent adjustments, energy-efficient upgrades, and responsive property management enhance tenant satisfaction and retention. Happy tenants stay longer, reducing turnover costs. Small improvements—like updated appliances or better lighting—can justify higher rents without major renovations. Over time, these optimizations compound, increasing both income and property value. A well-designed Cash Flow Engine doesn’t require constant attention, but it does require thoughtful oversight. When built with intention, it becomes the most reliable part of your financial foundation.

Avoiding Common Layout Traps

Even with a solid plan, investors fall into predictable traps that undermine their layout strategy. These pitfalls aren’t always obvious at first, but they accumulate over time, eroding returns and increasing stress. Recognizing them early allows for course correction before damage becomes irreversible. Awareness is the first line of defense against poor outcomes.

One of the most common traps is overconcentration. This happens when too much capital is tied up in a single market, property type, or income model. An investor might own three houses in one neighborhood, making them vulnerable to local downturns. Or they may rely entirely on short-term rentals, only to face new regulations that limit bookings. Overconcentration creates fragility. A single event can disrupt the entire portfolio. The solution is periodic review—assessing whether your holdings are still balanced and adjusting as needed.

Another trap is ignoring maintenance cycles. Properties require ongoing upkeep, and deferring repairs leads to larger expenses down the road. Some investors focus so much on acquisition that they neglect the cost of ownership. Roofs, HVAC systems, and plumbing have finite lifespans. Budgeting for these predictable expenses prevents cash flow disruptions. A well-structured layout includes a reserve fund for maintenance, ensuring that surprises don’t derail financial plans.

Misjudging market shifts is also dangerous. Trends change—remote work alters demand for urban housing, interest rates affect affordability, and local policies impact rental rules. Investors who fail to monitor these shifts may hold properties in declining areas while missing opportunities elsewhere. Staying informed through local news, real estate reports, and tenant feedback helps maintain alignment with reality. A flexible layout allows for adaptation, not rigid adherence to outdated assumptions.

Finally, emotional attachment can distort decisions. Selling a property that no longer fits the layout may feel like failure, even if it’s the smart move. Holding onto underperforming assets “just in case” ties up capital that could be better used elsewhere. Detachment is essential. Properties are tools, not trophies. Regular evaluation—measuring performance against goals—keeps the portfolio aligned with strategy. Avoiding these traps isn’t about perfection; it’s about creating a system that learns, adapts, and improves over time.

Building Your Personalized Real Estate Strategy

No two investors have the same goals, resources, or risk tolerance. A young professional with high income and low savings has different needs than a parent nearing retirement with a paid-off home. A personalized real estate strategy starts with self-assessment: What are your financial objectives? How much time can you dedicate to management? What level of risk makes you uncomfortable? Answering these questions shapes the ideal layout for your life.

Begin by defining your primary goal—whether it’s generating passive income, building long-term wealth, or preparing for retirement. This determines the balance between cash flow and appreciation in your portfolio. If monthly income is critical, prioritize the Cash Flow District. If you’re decades from retirement, the Growth Corridor may take precedence. Your time horizon matters. Long-term investors can tolerate more volatility, while those nearing financial independence need stability.

Next, assess your resources. How much capital do you have for down payments? What is your credit profile? Can you qualify for financing? Do you have time to manage properties, or will you need professional help? These practical considerations influence property selection and location. Starting small is perfectly valid. Many successful investors began with a single rental and expanded gradually as equity and experience grew.

Then, design your zones based on this information. Allocate percentages to each district—perhaps 60% Cash Flow, 25% Growth, 10% Stability, and 5% Flex. These ratios can evolve as your situation changes. Use this framework to evaluate every potential purchase. Does it fit the zone you need? Does it improve balance? Does it align with your timeline? This discipline prevents impulsive buys and keeps you on track.

Finally, commit to regular reviews. At least once a year, assess each property’s performance, market conditions, and personal goals. Are rents competitive? Are expenses under control? Has your financial situation changed? Adjust the layout as needed—selling underperformers, upgrading to better assets, or shifting focus. Real estate is a long game, but it’s not set-and-forget. A personalized strategy evolves with you, turning intention into lasting results.

Conclusion

Real estate investing isn’t just about buying property—it’s about designing a system that grows with purpose. A well-thought-out investment layout turns scattered assets into a coordinated force, maximizing returns while minimizing avoidable risks. By focusing on structure, not just speculation, you build not just wealth—but lasting financial confidence. The most successful investors aren’t those who chase every trend, but those who create a plan and stick to it with discipline. Whether you’re just starting or reevaluating an existing portfolio, the power lies in how you organize your holdings. With clear zones, balanced diversification, and a focus on sustainable cash flow, you can build a real estate strategy that works for you, not against you. Over time, this approach compounds—not just in dollars, but in peace of mind.