Why Are You Still Guessing Your Spending Habits When Your Phone Knows Better?

We’ve all been there—surprised by a low bank balance, wondering where the money went. It’s not about big purchases; it’s the small, repeated choices that slip under the radar. But what if your phone could quietly learn your habits and help you save without sacrifice? I tried letting technology watch over my spending, and it didn’t just cut costs—it brought peace of mind. This is not about tight budgets or willpower. It’s about working smarter, with tools that understand real life.

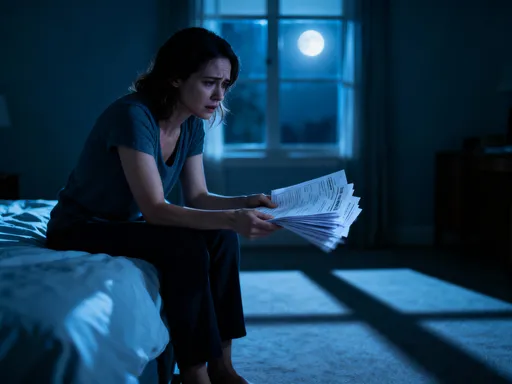

The Moment I Realized I Was Blind to My Own Spending

It happened on an ordinary Tuesday. I walked into the grocery store after a long day with my youngest from soccer practice, thinking I’d just grab a few things—milk, eggs, maybe some fruit. Two carts later, I stood at the checkout, heart sinking as the total flashed on the screen. I hadn’t planned to spend that much. But there it was, again. And when I got home and checked my bank app, the number made me pause. My balance was lower than I thought, and I couldn’t explain why.

I sat at the kitchen table, scrolling through my transactions, trying to piece together the week. Was it the gas fill-up? The birthday gift I picked up last-minute? The coffee I grabbed every morning before school drop-off? It wasn’t one big thing. It was all the little things, adding up without me noticing. That moment hit me hard. I realized I wasn’t managing my money—I was just reacting to it. And worse, I felt out of control. I’ve always considered myself responsible. I pay bills on time, I don’t carry credit card debt, and I try to save. But still, I didn’t truly know where my money was going.

That frustration led me to ask a simple question: What if I didn’t have to guess anymore? What if there was a way to see the full picture without spending hours with a spreadsheet? I wasn’t looking for a strict budget or another lecture about cutting lattes. I wanted clarity—without the stress. And that’s when I started exploring how technology could help me understand my spending in a way that actually fit my life.

How My Phone Learned What I Couldn’t See

I downloaded a personal finance app that promised to track spending automatically. I’ll admit, I was skeptical at first. Would it really work? Would I have to manually log every purchase? But the setup was surprisingly simple. I linked my checking account, and within minutes, the app had pulled in weeks of transaction history. Everything was there—groceries, gas, online orders, even that one-time donation I’d forgotten about.

What amazed me was how the app started organizing my life without me lifting a finger. It automatically sorted my purchases into categories: food, transportation, subscriptions, household. I didn’t have to tag anything. It just knew. And slowly, patterns began to emerge. I saw that I was spending more on convenience foods during busy weeks. I noticed a $12.99 charge every month from an app I hadn’t used in months. And there it was—the coffee habit. Five days a week, $4.50 each time. That’s over $90 a month, just for morning stops.

But here’s the thing: the app didn’t shame me. It didn’t pop up with red alerts or tell me I was failing. It just showed me the facts, clearly and calmly. It was like having a quiet observer who knew my routine better than I did. And that awareness changed everything. I didn’t feel guilty—I felt informed. For the first time, I could see my financial life not as a mystery, but as a story I could understand and shape.

Security Was My Biggest Worry—Here’s What Actually Happened

Let’s be honest—linking my bank account to an app felt scary at first. I kept asking myself, “Is this safe? What if someone gets access to my money?” I’ve heard stories about data breaches and scams. I didn’t want to trade convenience for risk. So before I went all in, I did my homework. I read reviews, checked the app’s privacy policy, and looked into how it protected user data.

What I learned made me feel much better. The app uses bank-level encryption, which means your financial information is scrambled and unreadable to anyone who might intercept it. It also supports two-factor authentication, so even if someone got my password, they couldn’t log in without a code sent to my phone. Plus, the app doesn’t store my actual bank login details—it connects through a secure third-party service that banks themselves use for these kinds of integrations.

After a few weeks of using it, my fear turned into confidence. I never had a single security issue. In fact, the app started sending me alerts for unusual activity—like a charge in a city I’d never visited. It was actually helping me protect my account. I realized that in some ways, I was safer with the app than I was checking my balance manually once a week. Technology wasn’t increasing my risk—it was reducing it. That shift in mindset was huge. I wasn’t giving up control. I was gaining a smart partner who helped me stay on top of things.

From Data to Daily Decisions: Small Changes, Big Results

Knowledge is power, but only if you use it. Once I could see my spending patterns, I started making small, realistic changes. I didn’t go cold turkey on coffee, but I decided to make it at home three days a week. That simple switch saved me about $55 a month. I also paused two subscriptions I wasn’t using—just clicked a button in the app, and they were gone. No guilt, no hassle.

One of the most helpful features was the weekly summary. Every Sunday evening, the app sent me a friendly recap: total spending, top categories, and how I compared to previous weeks. It wasn’t a report card—it was a conversation starter. I’d sit with my tea and review it like a check-in with myself. “Huh, I spent more on groceries this week. Was it the farmers market? Did I overbuy?” These little reflections helped me stay aware without feeling overwhelmed.

Within two months, I’d saved enough to plan a weekend getaway with my sister—something I’d been putting off for months. And the best part? I didn’t feel deprived. I didn’t stop buying things I loved. I just made smarter choices, guided by real insight. The app didn’t force me to change. It helped me choose change. That’s the difference between restriction and empowerment.

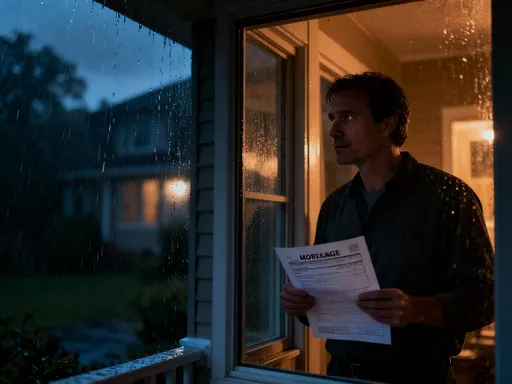

How This Changed More Than Just My Budget

What surprised me most was how this small shift affected the rest of my life. I started sleeping better. I’m not kidding. Before, I’d lie awake sometimes, worrying about money—was I saving enough? Could I afford the car repair? Would the kids’ camp fees come out okay? Now, that constant background noise is quieter. I know where I stand. And that peace of mind has spilled into everything.

At work, I feel more focused. I’m not distracted by financial stress. At home, our family conversations are calmer. My partner and I used to have little tensions around money—“Did you really need that?” “Why is the electric bill so high?” Now, we look at the app together, talk about our spending as a team, and plan ahead. It’s brought us closer, not further apart.

Even my kids have noticed. I used to say “We can’t afford that” more than I wanted to. Now, I can say, “Let’s see how it fits into our plan,” and we talk about priorities. It’s turned money from a source of stress into a tool for teaching and connection. And honestly, I feel more like myself—calm, capable, and in charge. That’s not just about dollars and cents. It’s about confidence, clarity, and emotional well-being.

Making It Work for You: A Simple Start Without Overwhelm

If you’re thinking about trying this, I get it. It can feel like one more thing to manage. But here’s what I’ve learned: start small. You don’t need to track every account or set up complex rules on day one. Pick one bank account or credit card you use most. Link it to a trusted app—look for one with strong reviews and clear security features. Let it run in the background for a week. Just watch. Don’t judge. Just observe.

Then, set a weekly reminder—maybe Sunday night, with your favorite drink—to check your summary. Look for one pattern that stands out. Maybe it’s lunch out during workdays, or online shopping after bedtime. Pick one small thing you’d like to adjust, and try it for a week. Maybe pack lunch three times instead of buying. Or delay a purchase by 24 hours to see if you still want it.

Turn notifications into gentle nudges, not stress triggers. For example, set an alert for when you’re near your monthly dining limit—not to stop you, but to make you pause and decide. And remember, this isn’t about perfection. It’s about progress. Some weeks will be higher than others. That’s okay. Life happens. The goal isn’t to eliminate every extra dollar—it’s to understand your choices so you can make them with intention.

Technology That Feels Human—And Why That Matters

What made this different from every other money tool I’ve tried is that it didn’t feel like a robot scolding me. It didn’t demand I live a minimalist life or give up everything fun. It adapted to me. It learned my rhythm—busy weeks, quiet weeks, holidays, emergencies. It didn’t expect me to be perfect. It just showed up, consistently, with useful information and quiet support.

That’s the kind of technology I trust. Not flashy gadgets or complicated systems, but tools that understand real life. The best tech doesn’t replace human judgment—it enhances it. It gives us space to breathe, think, and choose. It doesn’t make us more disciplined by force. It helps us become more aware, so we can act with purpose.

For me, this journey wasn’t just about saving money. It was about reclaiming my time, my energy, and my peace. It was about feeling like I’m the one in charge—not my habits, not my impulses, not the chaos of daily life. And it reminded me that taking care of myself isn’t selfish. It’s necessary. When I feel grounded financially, I’m a better mom, a better partner, a better friend.

So if you’ve ever looked at your bank balance and felt that quiet panic, know this: you’re not alone. And you don’t have to figure it all out on your own. There are tools that can help—tools that don’t judge, don’t overwhelm, and don’t demand more from you than you have to give. They just wait, quietly, ready to help you see clearly. And sometimes, that’s all it takes to change everything.