How I Navigated Mortgage Planning Without Falling Into Risk Traps

Buying a home felt like stepping into a financial maze—exciting, but full of hidden risks. I thought the hardest part was saving for a down payment, but mortgage planning turned out to be the real challenge. Rates, terms, and long-term commitments crept up on me. What I didn’t realize? Poor risk assessment could’ve cost me years of financial freedom. This is how I learned to balance smart debt, protect my income, and build equity—without losing sleep.

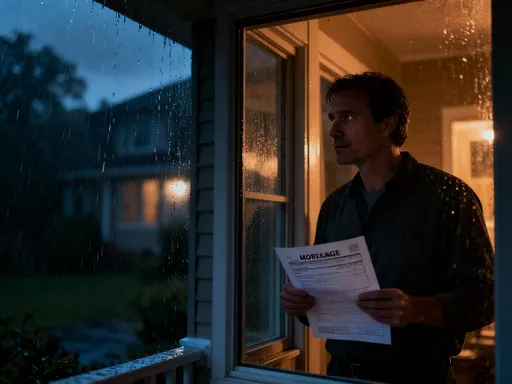

The Hidden Pressure Behind Homeownership Dreams

For many, owning a home represents stability, success, and a place to raise a family. It’s a milestone that carries deep emotional weight. Yet beneath the dream lies a complex financial reality often overlooked. The pressure to achieve homeownership can cloud judgment, leading people to rush into decisions before their finances are truly ready. I was no exception. When I received mortgage pre-approval, I felt a surge of accomplishment, as if I had passed a financial exam. But approval from a lender doesn’t mean you’re fully prepared for the long-term responsibilities that follow. Lenders evaluate credit scores, income, and debt levels, but they don’t assess your emergency savings, job stability, or future life changes. I once believed that meeting the lender’s criteria meant I was safe—until I faced an unexpected income drop and realized how fragile my situation could become.

Emotional readiness and financial readiness are not the same. The desire to own a home can create a sense of urgency, pushing individuals to stretch their budgets beyond sustainable limits. This emotional momentum often leads to underestimating ongoing costs like property taxes, insurance, maintenance, and utilities. These expenses can add thousands of dollars annually, turning what seemed like an affordable monthly payment into a financial burden. I learned this the hard way when I moved into my first home and was surprised by the cumulative cost of repairs and routine upkeep. It’s essential to separate the emotional appeal of homeownership from the practical evaluation of affordability. A home should enhance your financial security, not jeopardize it. That means looking beyond the monthly mortgage number and considering how the entire package fits into your long-term financial picture.

Another overlooked factor is the psychological weight of long-term debt. A 15- or 30-year mortgage is not just a financial commitment—it’s a life commitment. It affects your ability to relocate for better job opportunities, pursue further education, or support aging parents. I didn’t consider how tied I would feel to my home, especially when I later wanted to downsize or move closer to family. The illusion of flexibility disappears once you’re locked into a fixed location and a long-term payment plan. That’s why it’s crucial to assess not just whether you can afford the mortgage today, but whether it aligns with your projected lifestyle and goals over the next decade or more. True readiness means evaluating your emotional expectations alongside your financial capacity, ensuring that homeownership supports, rather than disrupts, your overall well-being.

Understanding Mortgage Risk Beyond Interest Rates

When most people think about mortgage risk, they focus on interest rates—the lower, the better. It’s understandable; rate fluctuations make headlines and directly impact monthly payments. But interest rates are only one piece of a much larger puzzle. The real risk lies in how stable your payments remain over time, how your loan is structured, and how life events might affect your ability to keep up with obligations. I once considered an adjustable-rate mortgage (ARM) because the initial rate was significantly lower than fixed-rate options. It seemed like a smart way to save money in the early years. What I didn’t fully grasp was that ARMs can reset after a few years, potentially increasing my payment by hundreds of dollars overnight—especially if interest rates rise.

Fixed-rate mortgages offer predictability, which is a major advantage for long-term planning. Knowing exactly what your payment will be for the next 15 or 30 years allows for greater budgeting confidence. However, even a fixed-rate loan isn’t risk-free. If your income is unstable or your job sector is vulnerable to economic shifts, a steady payment can still become unaffordable. I learned this when a temporary work slowdown reduced my freelance income by nearly 40% for several months. Even with a fixed mortgage, I had to dip into savings to cover the difference. This experience taught me that loan structure matters, but so does personal financial resilience. A “safe” mortgage on paper can become risky in real life if your income doesn’t match the long-term commitment.

Other often-overlooked risk factors include inflation, property value fluctuations, and changes in tax policy. Inflation can erode purchasing power, making fixed payments feel more burdensome if wages don’t keep pace. Property values don’t always rise—there are periods of stagnation or decline, especially in certain regions or economic climates. If you need to sell during a downturn, you could end up underwater on your mortgage, owing more than the home is worth. Additionally, changes in property tax rates or the elimination of mortgage interest deductions can increase your effective housing cost. These factors aren’t always within your control, but they should be part of your risk assessment. Instead of chasing the lowest rate, I began evaluating mortgage options based on how well they aligned with my personal risk tolerance, income stability, and long-term financial goals.

Stress-Testing Your Financial Foundation

Before finalizing my mortgage, I started asking myself tough questions: What if I lost my job? What if a family member needed medical care? What if interest rates rose and my other expenses increased? These aren’t pleasant thoughts, but they’re necessary. I realized that to avoid future financial strain, I needed to stress-test my budget—just as banks stress-test loan applicants. Stress-testing means simulating financial shocks to see whether your current income, savings, and debt levels can withstand real-world disruptions. It’s not about predicting the future, but about preparing for uncertainty. I created a simple model using three scenarios: a 20% income reduction, a major unexpected expense (like a car repair or medical bill), and a combination of rising interest rates and increased living costs. Each scenario revealed vulnerabilities I hadn’t noticed before.

For example, under the 20% income drop scenario, I discovered that my mortgage payment would consume nearly half of my remaining income, leaving little room for other essentials. That was a red flag. I also realized that my emergency fund, while better than nothing, wouldn’t cover more than three months of expenses if multiple setbacks occurred at once. This exercise pushed me to adjust my home price target and increase my savings goal before moving forward. Stress-testing doesn’t require complex software or financial modeling skills. You can do it with a spreadsheet or even pen and paper. List your monthly income and expenses, then reduce income by 10–30% or increase expenses by a fixed amount. See how long your savings would last and whether you could maintain mortgage payments without going into debt.

The benefit of stress-testing is that it shifts your mindset from optimism to preparedness. Most people plan based on best-case scenarios, but life rarely goes exactly as expected. By testing your financial resilience, you gain a clearer picture of what you can truly afford—not just what lenders say you can borrow. I found that this process helped me set more realistic expectations and avoid the temptation to stretch for a larger home. It also encouraged me to strengthen my financial foundation by building a larger emergency fund, reducing other debts, and increasing income streams where possible. Stress-testing isn’t a one-time exercise; I now revisit it annually or whenever a major life change occurs, such as a new job, marriage, or the birth of a child. It’s become a core part of my financial discipline, ensuring that my mortgage remains manageable no matter what life brings.

The Debt-to-Income Tightrope: Balancing Mortgage with Other Obligations

Your mortgage doesn’t exist in isolation. It shares space with student loans, car payments, credit card debt, childcare costs, and future financial goals like retirement and college savings. One of the biggest mistakes I made early on was focusing only on the mortgage payment, ignoring how it fit into my total financial picture. I qualified for a loan based on my debt-to-income (DTI) ratio, but the lender’s calculation didn’t account for my long-term savings goals or potential life changes. When I moved in, I quickly realized that the large mortgage payment left little room for building an emergency fund or contributing consistently to retirement. Homeownership was becoming a debt trap rather than a step toward financial security.

The debt-to-income ratio is a key metric lenders use to assess risk, typically calculated by dividing your total monthly debt payments by your gross monthly income. A DTI below 36% is generally considered healthy, with no more than 28% going toward housing. But these are guidelines, not guarantees of financial comfort. I found that even with a DTI of 32%, I felt financially stretched because the ratio didn’t reflect my other obligations or my desire to save. That’s why it’s important to calculate your *true* DTI—one that includes all recurring debts and savings goals. I started tracking every monthly obligation, from insurance premiums to subscription services, and factored in my target retirement contributions. This gave me a more accurate picture of how much I could realistically afford.

Once I saw the full picture, I made adjustments. I lowered my home price target, chose a slightly longer loan term to reduce monthly payments, and focused on increasing income through side work. I also negotiated with lenders to secure a better rate, which saved hundreds over time. The goal wasn’t to minimize debt at all costs, but to maintain balance. A manageable DTI creates breathing room for life’s uncertainties and future goals. It protects your ability to adapt when circumstances change. By keeping my DTI below a comfortable threshold—closer to 25%—I gained flexibility. I could handle unexpected expenses without panic, contribute to savings, and still enjoy a stable home life. This balance is what separates sustainable homeownership from financial strain.

Equity Growth vs. Long-Term Risk: Planning for the Ups and Downs

Many people assume that buying a home automatically builds wealth. While real estate can be a powerful tool for equity growth, it’s not a guaranteed or immediate path to riches. I once believed that rising property values would take care of everything, only to watch my neighborhood’s market stagnate for several years. During that time, I was still paying the mortgage, taxes, and maintenance—without seeing a return on investment. This taught me that equity growth is a long-term process influenced by both market conditions and personal financial behavior. It’s not just about what the home is worth, but how you manage the loan and associated costs.

There are several ways to build equity: through principal repayment, home value appreciation, and property improvements. The most reliable method is consistent principal reduction. With a traditional amortizing loan, early payments are mostly interest, so equity builds slowly at first. I began making extra principal payments whenever possible, which shortened the loan term and reduced total interest paid. This strategy increased my equity faster and gave me more flexibility down the road. Refinancing can also play a role, especially when rates drop significantly. I refinanced once after rates fell, lowering my monthly payment and redirecting the savings toward principal. However, refinancing isn’t always beneficial—it comes with closing costs and can reset the amortization clock, so it requires careful evaluation.

Market appreciation is less predictable. While some areas see steady growth, others remain flat or decline due to economic, demographic, or policy changes. I learned to research neighborhood trends, school quality, employment rates, and development plans before buying. These factors influence long-term value more than short-term price swings. Maintenance is another critical component. Neglecting repairs can erode value, while thoughtful upgrades can enhance it. I budgeted annually for maintenance, treating it as a non-negotiable expense. Property taxes and insurance also affect net returns. Higher taxes can offset appreciation, especially if they rise faster than income. By understanding these variables, I shifted from passive hoping to active planning—focusing on what I could control, rather than relying on market luck.

Insurance, Reserves, and Exit Strategies: Preparing for the Unexpected

No mortgage plan is complete without safeguards. I used to think that as long as I could make the monthly payment, I was safe. But a medical leave, job loss, or major home repair can change everything in an instant. That’s why protective layers—like homeowners insurance, emergency reserves, and exit strategies—are essential. Homeowners insurance is required by lenders, but the minimum coverage may not be enough. I reviewed my policy and increased coverage to include replacement cost and liability protection, ensuring I wouldn’t face massive out-of-pocket expenses after a disaster. I also added umbrella insurance for extra liability protection, a small cost that provides significant peace of mind.

Equally important is the emergency reserve. I now keep 6–9 months of living expenses in a liquid, accessible account. This fund covers mortgage payments, utilities, and essentials if income is interrupted. It’s not part of retirement savings or invested in the market—it’s strictly for emergencies. Building this reserve took time, but it’s the difference between staying in my home during a crisis and facing foreclosure. I also explored exit strategies. While I hope to stay in my home long-term, I recognize that life changes. If I need to relocate for work or downsize due to health, I want options. That means understanding local market conditions, keeping the home in good condition, and monitoring equity levels. A forced sale in a weak market can lead to financial loss, so I avoid overextending myself.

Other risks are less obvious but equally important. Local economic decline, zoning changes, or environmental factors can affect property value and livability. I stay informed about city planning, school district ratings, and infrastructure projects. These factors influence long-term desirability and resale potential. By considering them now, I reduce the chance of being trapped in a depreciating asset. Risk management isn’t about fear—it’s about foresight. With the right protections in place, I can face the unexpected with confidence, knowing I’ve built resilience into my homeownership journey.

Building a Mortgage Strategy That Adapts Over Time

My original mortgage plan was based on my income, family size, and goals at the time. But life evolves. Jobs change, children grow up, financial priorities shift. A static mortgage strategy can quickly become outdated. I now treat my mortgage as part of a dynamic financial plan—one that adapts as my circumstances change. Each year, I conduct a financial review: I assess my income, net worth, savings rate, and debt levels. I check whether my mortgage still aligns with my goals. If rates have dropped significantly, I consider refinancing. If my income has increased, I evaluate whether to accelerate principal payments. This annual check-in keeps me proactive rather than reactive.

Flexibility is key. I chose a 30-year fixed loan for its predictability, but I’m not locked into the original repayment schedule. By making occasional extra payments, I’ve shortened the effective term without losing liquidity. I also monitor broader economic indicators, like inflation and interest rate trends, to anticipate changes in my financial landscape. When my children near college age, I may adjust my strategy to preserve more cash flow. The goal isn’t to optimize every dollar, but to maintain balance and resilience. A good mortgage strategy doesn’t demand perfection—it demands awareness and adaptability.

Over time, I’ve learned that financial security comes not from owning a home, but from managing it wisely. The house itself is just a structure. The real value is in the financial clarity, discipline, and peace of mind that come from thoughtful planning. By treating mortgage planning as an ongoing process of risk assessment and adjustment, I’ve turned what could have been a source of stress into a foundation for long-term stability. The journey isn’t about avoiding risk entirely—it’s about understanding it, preparing for it, and moving forward with confidence.