How I Tamed My Mortgage Beast Without Losing Sleep

Remember that sinking feeling when your mortgage payment eats half your paycheck? I’ve been there—stressed, overwhelmed, and secretly terrified of missing a due date. But after years of trial, error, and a few smart swaps, I cracked the code. This isn’t about extreme frugality or risky investments. It’s about real, doable cost control that actually works. Let me walk you through how I took back control—without sacrificing my sanity. The journey began not with a windfall or a miracle, but with clarity. I stopped seeing my mortgage as a fixed burden and started viewing it as a dynamic financial relationship—one that could be shaped, managed, and even optimized. That shift in mindset changed everything.

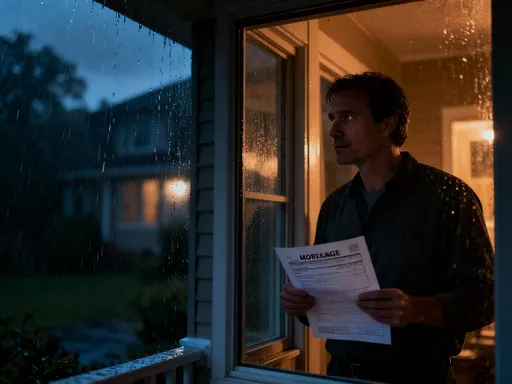

The Mortgage Monster in the Room

Mortgages are often sold as simple transactions: you borrow money to buy a home, and you pay it back over time with interest. But the reality is far more complex, especially for homeowners who feel trapped by rising payments, stagnant incomes, or unexpected expenses. The true weight of a mortgage isn’t just in the monthly check you write—it’s in the cumulative effect of interest, taxes, insurance, and missed opportunities. For many families, the mortgage becomes less of a home investment and more of a financial anchor, dragging down their ability to save, invest, or respond to life’s surprises.

One of the most misunderstood aspects of mortgage costs is the long-term impact of interest. Even with historically low rates, a 30-year loan can result in paying double or more than the original home price over time. A $300,000 mortgage at 4% interest, for example, will cost nearly $515,000 in total payments over three decades. That staggering difference—over $200,000 in interest alone—often goes unnoticed because it’s spread out over time. But it’s real money, and it represents a massive opportunity cost. Every dollar paid in interest is a dollar not invested in retirement, education, or emergency savings.

Beyond the principal and interest, homeowners also shoulder property taxes and insurance, typically collected through an escrow account managed by the lender. While this system offers convenience, it can obscure the full picture of housing costs. Property taxes vary widely by location and can increase annually, sometimes sharply. Homeowners insurance premiums are also subject to change based on claims history, local risk factors, and market conditions. When combined, these additional costs can add hundreds of dollars to the monthly housing burden—money that could otherwise be used to reduce debt or build wealth.

The emotional toll is equally significant. Many homeowners report anxiety around their mortgage, especially when job security is uncertain or family expenses rise. This stress is compounded by a lack of flexibility. Unlike credit card debt, which can be paused or restructured, mortgage payments are fixed and mandatory. Missing even one payment can trigger late fees, credit damage, and eventually foreclosure. That constant pressure can affect sleep, relationships, and overall well-being. Recognizing these hidden layers—the financial, emotional, and opportunity costs—is the first step toward regaining control.

Refinancing: Timing Over Temptation

Refinancing is one of the most talked-about mortgage strategies, often promoted as a quick fix for high payments or rising rates. The idea is simple: replace your current loan with a new one that has better terms, ideally a lower interest rate. In theory, this reduces your monthly payment and total interest paid. But in practice, refinancing is far more nuanced, and timing is everything. Jumping into a refinance because rates dipped slightly can backfire if the costs outweigh the savings or if you extend the loan term unnecessarily.

The key to successful refinancing lies in calculating the break-even point—the number of months it takes for your monthly savings to cover the closing costs. These costs typically range from 2% to 5% of the loan amount and include application fees, appraisal charges, title insurance, and lender fees. For a $300,000 mortgage, that’s $6,000 to $15,000 in upfront expenses. If refinancing saves you $200 per month, you’ll need 30 to 75 months—2.5 to 6.25 years—to break even. If you plan to move or refinance again before then, the effort may not pay off.

Another common pitfall is resetting the loan clock. Some homeowners refinance from a 30-year to another 30-year term to lower their monthly payment, but this can extend the total repayment period and increase overall interest costs. For example, someone five years into a 30-year mortgage who refinances into a new 30-year loan effectively pushes their payoff date 25 years into the future. Even with a lower rate, they may end up paying more in interest over time. A smarter approach is to refinance into a shorter term—such as 15 or 20 years—if the monthly payment remains affordable. This accelerates equity buildup and reduces total interest.

Market timing also plays a critical role. Refinancing during a period of falling interest rates makes sense, but chasing every minor dip is unwise. Rates fluctuate daily, and locking in a new loan requires time and documentation. A better strategy is to set a target rate—such as 1% below your current rate—and wait for a stable window to act. Additionally, consider your credit score and debt-to-income ratio before applying. Lenders offer the best terms to borrowers with strong financial profiles, so improving these factors first can lead to more favorable outcomes.

Escrow Hacks: Take Back Control of Taxes and Insurance

Most lenders require borrowers to pay property taxes and homeowners insurance through an escrow account, collecting a portion of these costs each month along with the mortgage payment. While this ensures bills are paid on time, it also means homeowners lose control over when and how those funds are used. The money sits in an account, often earning no interest, while the lender holds it until the bills come due. For financially disciplined homeowners, opting out of escrow can be a powerful way to improve cash flow and even earn a modest return.

By paying taxes and insurance directly, you can keep the money in a high-yield savings account or short-term investment vehicle, earning interest over the year. For example, if your annual property tax bill is $6,000, setting aside $500 per month in a savings account with a 4% annual yield could generate over $100 in interest over 12 months. While that may not seem like much, it’s free money that otherwise would have gone to the lender. Over time, these small gains add up, especially if you manage multiple bills this way.

However, opting out of escrow comes with responsibilities. You must budget carefully and ensure the full amount is available when the bill is due. Missing a tax payment can result in penalties, liens, or even foreclosure in extreme cases. Insurance lapses can void coverage and leave you exposed to financial risk. Lenders may also require you to meet certain equity or credit thresholds before allowing escrow removal. Typically, you need at least 20% equity in your home and a clean payment history.

A practical middle ground is to maintain escrow for insurance while managing property taxes yourself, or vice versa. This reduces risk while still giving you some control. Alternatively, you can use automated savings tools—such as dedicated “buckets” in your online banking app—to set aside funds monthly. The goal is to treat these expenses as predictable, not surprising. When you budget for them proactively, you eliminate the shock of large annual bills and gain peace of mind knowing the money is ready when needed.

Prepayment Power: Smarter Than You Think

Making extra payments toward your mortgage principal feels like a virtuous act—like paying off debt faster and saving on interest. And in many cases, it is. But prepayment isn’t always the best financial move, especially if it comes at the expense of other priorities like emergency savings, retirement contributions, or high-interest debt. The key is to approach prepayment strategically, not emotionally.

One popular method is the biweekly payment plan, where you pay half your monthly mortgage every two weeks. Because there are 52 weeks in a year, this results in 26 half-payments—equivalent to 13 full payments annually. That extra payment each year can shorten a 30-year loan by several years and save tens of thousands in interest. However, some lenders charge fees for enrolling in such programs. A better alternative is to make the extra payment yourself each year—either as a lump sum or by increasing your monthly payment slightly.

Another effective strategy is targeted principal reduction. Instead of spreading extra payments evenly, apply them after large windfalls—such as tax refunds, bonuses, or gifts. A $5,000 bonus applied directly to principal can shave months off your loan term and save thousands in interest. Even small, consistent overpayments add up. Adding just $100 per month to a $300,000 mortgage at 4% can reduce the term by nearly five years and save over $30,000 in interest.

Still, prepayment should align with your broader financial picture. If you have credit card debt at 18% interest, that debt should take priority—paying it off delivers a higher return than mortgage interest savings. Similarly, if your employer offers a 401(k) match, contributing enough to get the full match is often more valuable than prepaying your mortgage. The goal isn’t to eliminate your mortgage at all costs, but to optimize your overall financial health. Prepayment works best when it’s part of a balanced strategy, not a reaction to guilt or pressure.

Side Hustles That Actually Offset Housing Costs

In today’s economy, many homeowners are looking beyond traditional budget cuts to find ways to cover housing expenses. One of the most effective approaches is generating side income—especially from underused assets. Unlike speculative ventures or high-effort jobs, these opportunities leverage what you already own: space, skills, and time. The income isn’t meant to replace your primary job, but to directly offset your mortgage and create breathing room in your budget.

Renting out a spare room is one of the simplest ways to generate steady income. In many markets, a furnished room can fetch $800 to $1,500 per month, depending on location and amenities. Platforms like Airbnb make it easy to list and manage short-term stays, though long-term tenants may offer more stability. Before starting, check local zoning laws and homeowners association rules, as some areas restrict short-term rentals. Also, consider the impact on privacy and household dynamics, especially if you have children or prefer a quiet home environment.

Another low-effort option is leasing unused parking space. If you live near a city center, hospital, or entertainment district, your driveway or garage could be in high demand. Renting it for $100 to $300 per month requires minimal effort—sometimes just installing a gate code or signage. Similarly, storing seasonal items like boats, RVs, or equipment on your property can generate extra income with little maintenance.

Home-based services are another avenue. If you have skills in baking, tutoring, fitness training, or crafting, you can offer them locally or online. Even a small garden can become a micro-business through selling produce at farmers’ markets or through community-supported agriculture. The key is to choose something sustainable and enjoyable, not draining. The goal is to create a reliable income stream that reduces your net housing cost without adding stress. Every dollar earned this way is a dollar less you need to pull from your paycheck to cover the mortgage.

Budgeting That Doesn’t Suck the Life Out of You

Traditional budgeting often fails because it’s too rigid, too restrictive, or too complicated. Many people try to track every dollar, cut out all luxuries, and stick to a spreadsheet that feels like a prison sentence. No wonder they give up within weeks. A better approach is a flexible, cost-aware system that prioritizes stability without sacrificing joy. The goal isn’t to eliminate spending—it’s to make every dollar work harder for you.

One effective framework is a modified version of the 50/30/20 rule, where 50% of income goes to needs, 30% to wants, and 20% to savings and debt repayment. For homeowners, this can be adjusted to prioritize the mortgage while still allowing for life’s pleasures. For example, if housing consumes 40% of your income, you can balance it by reducing discretionary spending slightly or increasing income through side efforts. The key is balance, not perfection.

Small daily changes can free up significant cash. Cutting unused subscriptions—streaming services, gym memberships, apps—can save $50 to $100 per month. Planning meals, buying in bulk, and using coupons can reduce grocery bills by 15% to 25%. Driving efficiently, combining errands, and maintaining your vehicle can lower fuel and repair costs. These aren’t drastic sacrifices—they’re mindful choices that add up.

Automating savings and debt payments ensures consistency without daily decision fatigue. Set up automatic transfers to a savings account or extra mortgage payments right after payday. When the money is moved before you see it, you’re less likely to spend it. At the same time, allow yourself guilt-free spending in the “wants” category—dining out, hobbies, travel. Deprivation leads to burnout. A sustainable budget includes room for joy, because financial wellness isn’t just about numbers—it’s about peace of mind.

When to Hold On—and When to Let Go

For many, the dream of homeownership includes staying in one home for decades, raising a family, and building equity. But life changes. Jobs relocate, family sizes shift, and financial priorities evolve. At some point, it may make more sense to downsize, move to a lower-cost area, or even rent temporarily. These decisions are often emotional, tied to identity and memories, but they should be guided by financial reality.

Downsizing to a smaller home or a less expensive market can dramatically reduce housing costs. A $500,000 home in a high-cost city might be replaced with a $300,000 home in a more affordable area, freeing up $200,000 in equity. That money can pay off debt, fund retirement, or provide a cushion for future needs. Lower property taxes, insurance, and maintenance costs further improve cash flow. For empty nesters or retirees, this can mean greater financial freedom and less physical upkeep.

Relocating for lower housing costs is another viable option. Some families have moved from coastal cities to the Midwest or South, cutting their mortgage in half while maintaining a similar lifestyle. Remote work has made this more feasible than ever. Even renting out your current home and moving to a rental elsewhere can make sense in certain markets, especially if property values have risen significantly.

The decision shouldn’t be rushed, but it shouldn’t be avoided either. Regularly reassess your housing situation—every five years or after major life events. Ask: Does this home still serve my needs? Is the cost justified by the value I get? Could I live more comfortably with less financial stress elsewhere? There’s no shame in changing course. What matters is making an intentional choice based on facts, not fear or nostalgia.

Building Wealth, One Smart Payment at a Time

Paying off a mortgage isn’t just about discipline—it’s about strategy. The journey from feeling overwhelmed to feeling in control doesn’t require radical changes or extreme sacrifices. It starts with awareness, continues with small, consistent actions, and grows through informed decisions. Every smart payment, every side income stream, every budget adjustment adds up over time, not just in dollars saved, but in confidence gained.

Wealth isn’t built overnight. It’s built in the quiet moments—when you choose to save instead of splurge, when you research refinancing instead of ignoring it, when you rent out a room instead of tightening your belt. These choices compound, just like interest, but in your favor. And the greatest return isn’t just financial. It’s the peace of mind that comes from knowing you’re not at the mercy of your mortgage—that you’re the one in charge.

You don’t have to be a financial expert to take control. You just need to start. Look at your mortgage not as a monster, but as a milestone—one that, with the right approach, can lead to greater freedom, stability, and security. The path is clearer than you think. And every step forward, no matter how small, brings you closer to the life you want.