How I Turned My Fashion Obsession Into Smarter Spending — Without Losing the Spark

We’ve all felt it — that rush when spotting the perfect jacket or a pair of shoes that just speak to you. But what if your fashion habit could do more than just boost your confidence? What if it actually helped grow your money? I used to blow my budget on trends, until I discovered simple investment tools that changed everything. This isn’t about getting rich — it’s about spending smarter, protecting your cash, and still looking good while doing it. Let me walk you through how I made fashion work for me, not against my wallet. It started with a single realization: every dollar spent doesn’t have to vanish. Some choices can preserve value, others can even generate returns. The key was learning to see fashion not as a weakness in my budget, but as a potential ally — if approached with awareness, discipline, and a touch of strategy.

The Hidden Cost of Looking Good

Fashion is more than fabric and stitching — it’s emotion, identity, and expression. For many, updating a wardrobe brings joy, confidence, and a sense of renewal. Yet behind the excitement lies a financial reality often overlooked: the cumulative impact of repeated, small indulgences. A $50 blouse here, a $120 pair of boots there — these purchases may feel manageable in the moment, but over time, they can quietly drain hundreds or even thousands of dollars from a household budget. The real cost isn’t just the price tag; it’s the opportunity lost. That same money, if redirected or invested wisely, could contribute to long-term financial goals like building an emergency fund, saving for a family vacation, or securing a more stable retirement.

What makes fashion spending particularly tricky is its emotional pull. Retail therapy is a widely recognized behavior — the act of shopping to improve mood or relieve stress. While occasional treats are harmless, relying on fashion as a coping mechanism can lead to a cycle of overspending. Fast fashion, with its rapid turnover and low prices, amplifies this pattern. Brands release new styles weekly, creating a sense of urgency and fear of missing out. This constant churn encourages impulse buying and short-term ownership, where items are worn only a few times before being discarded or forgotten in the back of a closet. The result is a wardrobe full of underused clothing and a bank account that reflects poor value retention.

The shift begins with awareness. Recognizing personal spending triggers — whether it’s boredom, social media influence, or seasonal sales — is the first step toward control. It’s not about eliminating joy from shopping but about aligning it with financial health. Viewing clothing as more than just an expense opens up new possibilities. Some pieces, when chosen wisely, can maintain or even increase in value. Others, while purely consumable, can be planned for within a balanced budget. The goal is to move from reactive spending to intentional choices — understanding not just what you buy, but why. This mindset change transforms fashion from a financial liability into a potential tool for discipline and long-term planning.

Investment Tools That Fit Your Lifestyle

Just as a well-curated wardrobe simplifies daily decisions, the right financial tools can make money management feel effortless. For those who love fashion but want to protect their finances, integrating simple investment strategies into everyday life can create a powerful balance. The good news is that you don’t need a finance degree or a large sum of money to get started. Today’s digital landscape offers accessible, user-friendly platforms designed for beginners. These tools help redirect discretionary spending — including fashion budgets — into channels that generate growth over time, even in small increments.

One of the most effective entry points is micro-investing apps. These platforms allow users to invest spare change from everyday purchases. For example, if you buy a $45 dress and the app rounds up to $50, the $5 difference is automatically invested in a diversified portfolio of low-cost index funds or exchange-traded funds (ETFs). Over time, these small contributions compound, building a meaningful balance without requiring large, upfront commitments. The beauty of this approach lies in its invisibility — it operates in the background, making investing a passive habit rather than a daunting task. For fashion lovers, this means every purchase can contribute to financial growth, even if the item itself doesn’t hold long-term value.

Another practical tool is the strategic use of cashback credit cards — but only when used responsibly. Certain cards offer high rewards on retail or online shopping categories. By charging fashion purchases to such a card and paying off the balance in full each month, you can earn cashback or points without incurring interest. This effectively reduces the net cost of your purchases. The key is discipline: treating the card as a payment method, not a source of credit. When paired with a monthly budget, this strategy turns routine spending into a source of savings. Some users redirect their cashback earnings directly into a high-yield savings account or a Roth IRA, further enhancing long-term financial security.

For those ready to take a more active role, automated investment accounts offer a middle ground between simplicity and control. These platforms use algorithms to build and manage portfolios based on your risk tolerance and goals. Contributions can be set up as recurring transfers, ensuring consistency without constant oversight. The advantage for lifestyle-oriented investors is that these systems require minimal time and decision-making, freeing mental energy for other priorities. Whether it’s saving for a child’s education, a home upgrade, or personal freedom, these tools help align daily habits with future aspirations — proving that style and financial wisdom can coexist.

When Fashion Meets Value: What Actually Holds Its Worth

Not all fashion items are created equal when it comes to financial value. While most clothing depreciates quickly, certain pieces have the potential to retain or even appreciate in worth over time. Understanding the difference can transform the way you shop. The key lies in identifying items that possess specific characteristics: timeless design, high-quality craftsmanship, limited availability, and strong brand heritage. These factors contribute to sustained demand in both retail and resale markets, making them more than just wardrobe staples — they become assets with measurable value.

Take, for example, classic handbags from renowned designers. Models like the Chanel 2.55 or the Hermès Birkin have demonstrated consistent resale value, often selling for more than their original retail price. This isn’t accidental — it’s the result of deliberate brand strategy, controlled production, and enduring appeal. Limited edition releases, seasonal collaborations, and vintage pieces from iconic labels also tend to perform well in secondary markets. The same principle applies to footwear: well-maintained leather boots from heritage brands or rare sneaker editions can command premium prices years after purchase. These items are not immune to market fluctuations, but their track record suggests a higher likelihood of value preservation compared to mass-produced alternatives.

Condition plays a critical role in resale potential. A gently used jacket with no stains, missing buttons, or structural damage will always fetch a higher price than one showing heavy wear. Proper care — including correct storage, regular cleaning, and timely repairs — extends an item’s lifespan and maintains its marketability. Rarity is another key factor. Pieces produced in small quantities or discontinued by the brand often become more desirable over time. This scarcity drives demand, especially among collectors and fashion enthusiasts. Additionally, brand reputation matters. Labels with a legacy of quality and innovation tend to inspire greater consumer confidence, which translates into stronger resale performance.

Market demand is the final piece of the puzzle. Even a well-made, rare item won’t hold value if there’s no interest. Staying informed about fashion trends, collector preferences, and resale platform data can help guide smarter purchases. Websites and apps that track historical pricing and sales volume for specific items provide valuable insights. By combining these elements — quality, rarity, condition, and demand — shoppers can make more strategic decisions. The goal isn’t to turn every purchase into an investment, but to recognize which items are worth paying a premium for and which are better suited as short-term indulgences. This discernment builds financial awareness and reduces waste, aligning personal style with long-term value.

Turning Spending Into Strategy: The Reinvestment Loop

The most powerful financial habit isn’t saving alone — it’s creating a system where spending fuels growth. This is the essence of the reinvestment loop: a structured approach that turns fashion consumption into a cycle of value creation. Instead of viewing purchases as one-way transactions, this strategy encourages thoughtful buying, full utilization, strategic resale, and the redirection of profits into financial assets. When done consistently, even modest gains can compound over time, generating tangible results without sacrificing personal style.

The process begins with intentionality. Before making a purchase, ask: Will I wear this at least ten times? Does it fit my current lifestyle? Could it hold value in the future? These questions help filter out impulse-driven buys and focus on pieces with lasting utility or resale potential. Once acquired, the goal is to maximize wear. A coat worn throughout multiple seasons delivers far more value per dollar than one worn once and forgotten. Rotating and restyling existing pieces also extends their relevance, reducing the urge to buy new items unnecessarily.

When an item no longer serves its purpose, resale becomes the next step. Platforms like ThredUp, Poshmark, and Vestiaire Collective make it easy to sell gently used clothing, accessories, and footwear. The key is timing — selling while the item is still in demand, before trends shift or condition declines. Some users set a personal rule, such as reselling after three seasons of use or when a piece no longer fits their aesthetic. The proceeds from these sales can then be directed into low-risk investment vehicles, such as index funds, high-yield savings accounts, or education savings plans. Even a $50 profit from a single sale, when reinvested, contributes to long-term growth.

Over time, this cycle builds momentum. As more items are rotated through the loop, the total value recovered increases. Reinvested earnings generate returns, which can eventually fund future purchases without touching the primary budget. This creates a self-sustaining system where fashion is no longer a drain, but a contributor to financial health. The psychological benefit is equally important — it fosters a sense of control and empowerment. Rather than feeling guilty about spending, users begin to see their choices as part of a larger, purposeful strategy. This shift in perspective is what transforms casual shopping into intentional wealth-building.

Risk Control: Protecting Yourself While Experimenting

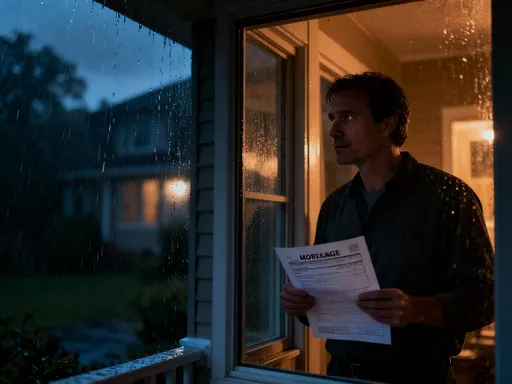

Every financial decision carries risk, and fashion-related spending is no exception. Emotions, social influences, and marketing tactics can cloud judgment, leading to choices that feel exciting in the moment but regrettable later. The key to sustainable success lies in establishing safeguards that protect your financial foundation while allowing room for enjoyment. Risk control isn’t about restriction — it’s about creating boundaries that ensure long-term stability.

One of the most effective strategies is setting clear personal limits. This includes defining a monthly fashion budget and sticking to it. Within that budget, you can allocate portions for different categories — for example, 70% for everyday wear, 20% for statement pieces, and 10% for fun or experimental items. This approach ensures that discretionary spending doesn’t compromise essential expenses like groceries, utilities, or savings goals. It also reduces the temptation to overspend by providing a structured framework for decision-making.

Another critical safeguard is avoiding lifestyle inflation. As income increases, it’s natural to want to upgrade your wardrobe. However, spending more just because you can afford it often leads to diminishing returns. A $300 blouse may feel luxurious, but if it doesn’t bring lasting value, it’s no different from a $30 one that gets worn more frequently. The focus should remain on utility, quality, and alignment with personal values — not on the price tag. Recognizing the difference between want and need helps maintain financial discipline, even in the face of rising income.

Impulse buying is a major risk, especially in an era of one-click shopping and targeted ads. The 48-hour rule is a simple but powerful tool to combat this. When you see something you love, wait two days before purchasing. This cooling-off period allows emotions to settle and rational thinking to take over. Often, the urge to buy fades, revealing whether the desire was fleeting or genuine. Similarly, being aware of hype-driven drops — limited releases designed to create urgency — can prevent overpaying for items that may lose value quickly. By separating fun spending from strategic purchases, you protect your financial goals while still enjoying the pleasures of fashion.

Practical Tricks to Stay on Track

Long-term financial success depends less on grand gestures and more on consistent, small habits. For fashion lovers, maintaining balance requires practical techniques that support discipline without eliminating joy. These methods are not about deprivation — they’re about creating structure that enhances freedom. When systems are in place, decision-making becomes easier, and confidence grows.

Budget batching is one such technique. Instead of tracking every small purchase, group your fashion spending into monthly or quarterly allocations. This creates a clear boundary and reduces mental fatigue. Once the batch is used, no additional spending occurs until the next cycle. It’s similar to meal planning — knowing what’s available helps avoid last-minute, unplanned choices. Some users pair this with a visual tracker, such as a savings thermometer, to monitor progress toward a larger goal, like funding a dream wardrobe or a future investment.

The 48-hour rule, mentioned earlier, is another powerful tool. It introduces a pause between desire and action, allowing for reflection. During this time, you can research the item, check reviews, compare prices, or try styling it with existing pieces. Often, this process reveals better alternatives or confirms that the purchase isn’t necessary. It also helps distinguish between emotional wants and functional needs, leading to more satisfying outcomes.

Regular wardrobe audits are equally important. Setting aside time every few months to review your closet helps identify underused items, spot gaps in your collection, and assess what truly brings value. This practice reduces redundancy — how many black sweaters do you really need? — and encourages creative reuse of existing pieces. It also supports the resale strategy by highlighting items ready for their next owner.

Finally, price-tracking tools can provide peace of mind. Apps and browser extensions monitor price history and alert you when items drop in cost. This prevents overpaying and reinforces patience. For those eyeing high-value pieces, waiting for a sale can save hundreds of dollars — money that can be redirected into investments. Together, these tricks form a supportive ecosystem that makes smart spending feel natural and rewarding.

Building a Sustainable Financial Style

True financial well-being isn’t measured solely by account balances or investment returns — it’s reflected in the freedom to live with intention and peace of mind. The journey of aligning fashion with finance is not about perfection, but about progress. It’s about making choices that honor both your personal expression and your long-term security. When spending is deliberate, guided by values and supported by simple tools, it becomes a form of self-respect.

Every small win deserves recognition. Maybe you resisted an impulse buy, sold a gently used coat for a profit, or redirected cashback into a growing savings account. These moments, though seemingly minor, build confidence and reinforce positive habits. Over time, they compound — not just financially, but emotionally. The anxiety that once accompanied credit card statements begins to fade, replaced by a sense of control and purpose.

Patience is essential. Wealth-building is rarely dramatic; it’s quiet, consistent, and cumulative. The same mindset applies to fashion — the most enduring styles are not those that scream for attention, but those that stand the test of time. By applying this principle to both wardrobe and wealth, you create a life that feels cohesive and authentic.

In the end, it’s possible to love fashion and be financially responsible. You don’t have to choose between looking good and feeling secure. With awareness, discipline, and the right tools, your spending can reflect your values, protect your future, and still bring joy today. That’s not just smart finance — it’s sustainable style.